The end of Summer 2021 is comming with new trends in the stock market. In the first week of September 2021, prices of key stocks have stayed near record highs. At the same time, volatility continues to increase and the market sentiment is gradually shifting to negative territories. The stock market dynamics appear to continually balance the factors that have affected the overal market since early 2021, such as COVID-19 pandemic new waves, the complex job market, the growing inflation, Chinese government actions on Tech, e-commerce companies, a new stock market, and electric vehicles, the end of the US unemployment benefits, and the overall US economic policies.

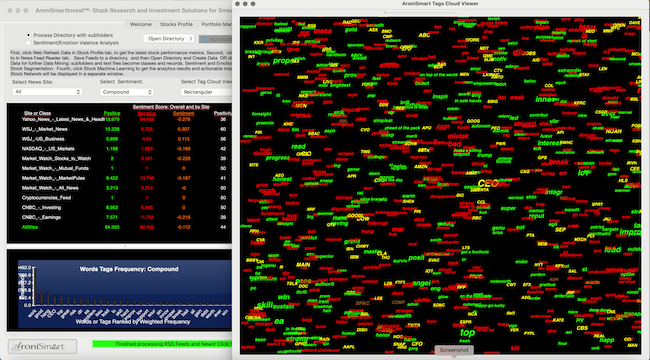

On September 5, 2021, the key stock market indices, while near record performances and almost flat vs the week before, ended with a mixed view (Dow Jones Industrial Average lost: -0.21%; Nasdaq gained: + 0.21 %; S&P 500 lost: - 0.03%, and Russel 2000 lost: -0.52%). AroniSmart™ team, leveraging the Machine Learning, Big Data ,Bayesian Network Analysis, Neural Network Analysis, Text Analytics, and Sentiment and Valence Analysis capabilities of the new improved AroniSmartInvest™ and AroniSmartIntelligence™, looked at the stock performance, market sentiment index and events driving the stock market as the end of Summer 2021 approaches ( For More on AroniSoft LLC and AroniSmart products and Terms and Contacts, click here). Key stocks driving the market at as of September 5, 2021 were identified.