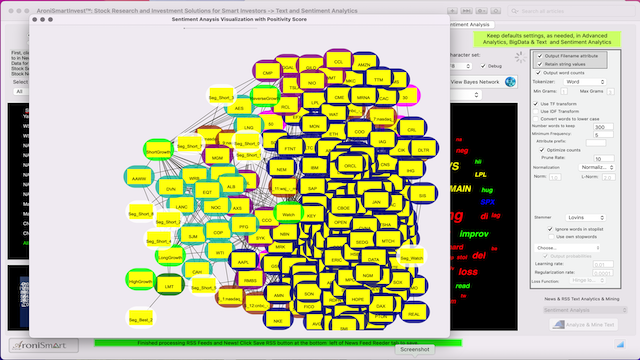

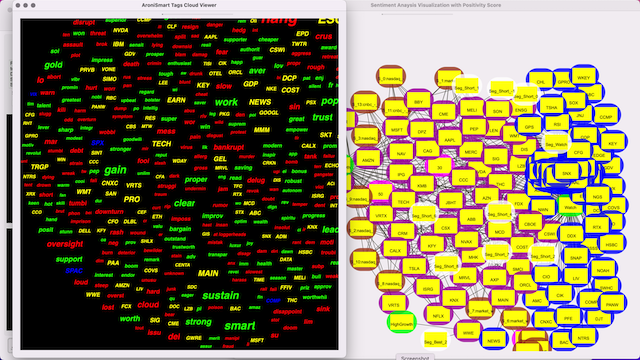

Since mid-Q2 2022, the stock market has been experiencing swing slide seesaw dynamics. After the high volatility mixed with some positive trends observed in July 2022, positive trends were observed in August 2022. On August 13, 2022, AroniSmart™ team, leveraging the NLP, Text and Sentiment Analysis, Machine Learning, Data Science, Time Series and Support Vector Machine capabilities and Dominance Analysis of AroniSmartInvest ™ and AroniSmartIntelligence™ tools, looked at the stock market news and trends. The analysis showed that by mid-Q3 2022 the dynamics had changed, with positive trends and improvements of all key market indices, except Crude Oil. On September 21, 2022 AroniSmart™ team updated the analysis. From the latest analysis, the team has come up with insights and highlights on key stocks and the market sentiment driving the dynamics of the stock market by towards the end of Q3 2022.

Investing

AroniSmartInvest and AroniSmartIntelligence Stock Market Sentiment Machine Learning and NLP Analysis: Update on Market Sentiment and Highlighted Stocks as of Mid-August 2022

In mid Q3 2022, the the stock market has been experiencing new dynamics. After the high volatility mixed with some positive trends observed in July 2022, positive trends have persisted . On July 26, 2022, AroniSmart™ team, leveraging the NLP, Text and Sentiment Analysis, Machine Learning, Data Science, Time Series and Support Vector Machine capabilities and Dominance Analysis of AroniSmartInvest ™ and AroniSmartIntelligence™ tools, looked at the stock market news and trends. The volatility of the stock market had continued, with mixed trends and both national and worldwide events and economic situation continued to drive the market dynamics, with the key indices in seasaw movements, some with signifcant negative trends . On August 13, 2022 AroniSmart™ team updated the analysis. From the latest analysis, the team has come up with insights and highlights on key stocks and the market sentiment driving the dynamics of the stock market by mid Q3 2022.

AroniSmartInvest and AroniSmartIntelligence Stock Market Sentiment Machine Learning and NLP Analysis: Update on Market Sentiment and Highlighted Stocks as of July 26, 2022

As the first month of Q3 2022 is almost ending, the the stock market remains highly volatile. The volatility has continued to increase following some positive trends observed in the first three weeks of July 2022. In early July 2022, AroniSmart™ team, leveraging the NLP, Text and Sentiment Analysis, Machine Learning, Data Science, Time Series and Support Vector Machine capabilities and Dominance Analysis of AroniSmartInvest ™ and AroniSmartIntelligence™ tools, looked at the stock market news and trends. The volatility of the stock market has continued and both national and worldwide events and economic situation had worsened the market dynamics, with the key indices being increasingly heavily negatively impacted. On July 26, 2022 AroniSmart™ team updated the analysis. From the latest analysis, the team came up with insights and highlights on key stocks and the market sentiment driving the dynamics of the stock market as Q3 2022 progresses.

AroniSmartIntelligence™ in Action: Apple (AAPL) and Exxon (XOM) Stock Performance and Momentum Analysis with Support Vector Machine and Dominance Analysis in Q3 2022

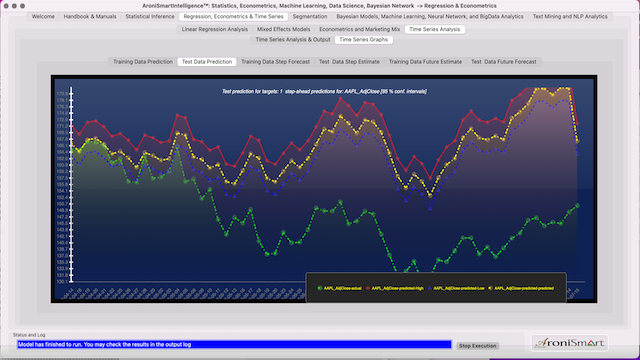

Apple Inc. (NYSE: AAPL) and Exxon (NYSE: XOM) have been delivering differential returns over the last years including in 2021 and and Q1-Q2 2022. At its height, by early December 2021, Apple stock price had risen by 125%, YoY. Since then stock growth has become negative, although still outperforming most of the stocks and the stock market indices, with -15% YTD as of July 15, 2022, vs 27.5% for NASDAQ Composite (^IXIC) and -13.90% for Dow Jones Industrial Average (^DJI). The oil industry has benefited during the period, with Crude Oil Aug 22 (CL=F) index growing by +29.73 % YTD and Exxon Mobil Corporation (XOM) by +38.16% YTD. The stock market has lost momentum while the oil industry has gained following the increasing market volatility, inflation, world events, and other dynamics since late Q3 2022. AroniSmart™ team, leveraging the Machine Learning Time Series capabilities, including Support Vector Machine, and Dominance Analysis of AroniSmartIntelligence™ and AroniSmartInvest™, has looked at the trends of the stock price of AAPL vs the stock prices of 20 selected companies between Q3 2021 and Q3 2022 and came up with insights and projections on the dynamics. The insights are presented below (for disclaimer and terms, check AroniSoft website).