In The Spotlight

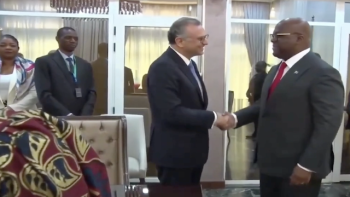

Massad Boulos in Signing Ceremony with DR Congo Foreign Affairs Minister Therese Kayikwamba Wagner and Rwandan Foreign Affairs Minister Olivier Nduhungirehe in DC on April 25, 2025

US Secretary of State Marco Rubio Hosting Signing Ceremony with DR Congo Foreign Affairs Minister Therese Kayikwamba Wagner and Rwandan Foreign Affairs Minister Olivier Nduhungirehe in DC on April 25, 2025

More News

-

CeCe Winans - Goodness of God Priscilla Marie Winans Love, known professionally as CeCe Winans, is a famous American gospel singer. Her achievements as a. gospel signer have earned Cece Winans many honors and awards including 15 Grammy Awards, the most for a female gospel singer, 31 GMA Dove Awards, 16 Stellar Awards, 7 NAACP Image Awards. Goodness of God, one of her best songs praises and worship the Lord. At age 9, John Hurt taught himself how to play the guitar. Working as sharecropper, he began playing at dances and parties. His music included blues, spirituals, country, bluegrass, folk, and contemporary rock and roll.

Priscilla Marie Winans Love, known professionally as CeCe Winans, is a famous American gospel singer. Her achievements as a. gospel signer have earned Cece Winans many honors and awards including 15 Grammy Awards, the most for a female gospel singer, 31 GMA Dove Awards, 16 Stellar Awards, 7 NAACP Image Awards. Goodness of God, one of her best songs praises and worship the Lord.

Advertisement

Get the following books on Amazon:

Legs of Tornado: The Human Who Outran the Wind, an African tale about a human from a humble upbringing who outran the wind, defeated evil spirits, overcame his fate, became a respected clan chief, and triumphed ever after.

Click Here to Get the books: Even Roosters Dream to Fly and Legs of Tornado

Even Roosters Dream to Fly along with Legs of Tornado are also available on Amazon worldwide and soon on several other platforms:

For more on the book, the author, the inspiration of the stories, Visit the author website here

Check the Book Video trailer of Even Roosters Dream to Fly, here

-

Mississippi John Hurt - You Got To Walk That Lonesome Valley John Smith Hurt, better known as Mississippi John Hurt, was an American country blues singer, songwriter, and guitarist. He was born in Mississippi on March 8, 1893 and passed away on November 2, 1966. At age 9, John Hurt taught himself how to play the guitar. Working as sharecropper, he began playing at dances and parties. His music included blues, spirituals, country, bluegrass, folk, and contemporary rock and roll.

John Smith Hurt, better known as Mississippi John Hurt, was an American country blues singer, songwriter, and guitarist. He was born in Mississippi on March 8, 1893 and passed away on November 2, 1966.

At age 9, John Hurt taught himself how to play the guitar. Working as sharecropper, he began playing at dances and parties. His music included blues, spirituals, country, bluegrass, folk, and contemporary rock and roll.

-

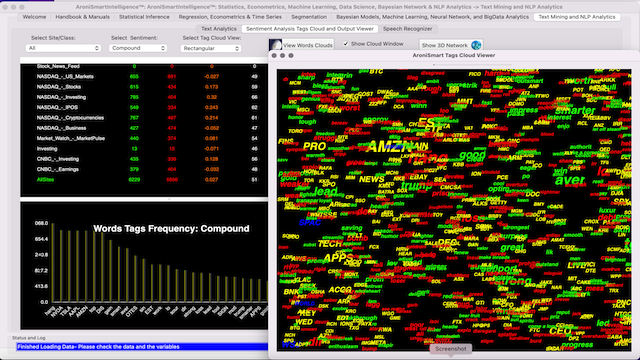

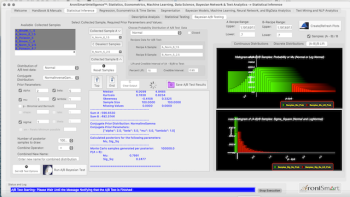

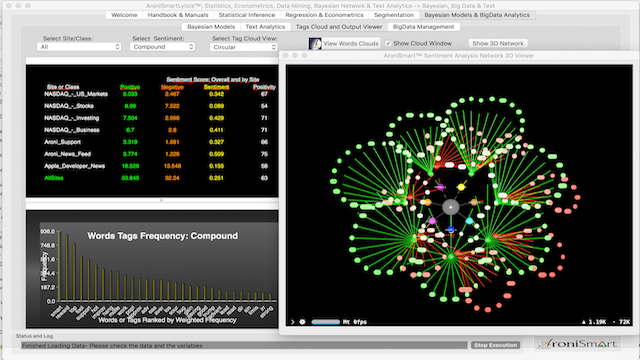

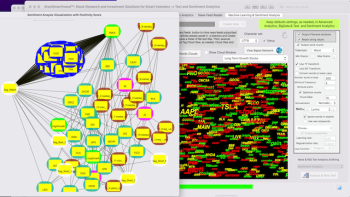

AroniSmartInvest™ In Action: Stocks Driving the Market in August 2020

On August 17 2020, the US stock market, especially the tech stocks, maintained momentum or rallied, pushing NASDAQ and S&P500 index to new highs.

AroniSmart™ team, leveraging the Machine Learning, Text Mining, and Sentiment and Valence Analysis capabilities of AroniSmartInvest™ and AroniSmartIntelligence™, analyzed the data and identified the stocks driving the momentum.

-

AroniSmartInvest™ In Action: Market Sentiment and Valence in August 2020

On August 17, 2020, the US stock market, especially the tech stocks, maintained momentum or rallied, pushing NASDAQ and S&P500 index to ned highs.

AroniSmart™ team, leveraging the Machine Learning, Text Mining, and Sentiment and Valence Analysis capabilities of AroniSmartInvest™ and AroniSmartIntelligence™, analyzed the data and the sentiment driving the market.

While the overall sentiment leans to positive, the sentiment in the stock market and investment circles is positive across the board.

Apple's "It's Glowtime" event kicked off on Monday 9/9/2024 at 10:00 a.m. Pacific Time. As expected, the event focused on iPhone 16, Apple Watch, and AirPods, with new or updated models unveiled. The iPhone 16 Pro are now bigger, faster, with more memory, improved cameras, and Apple Intelligence. The following products were unveiled: iPhone 16, Apple Watch Series 10, Apple Watch Ultra 2, AirPods 4, AirPods Pro 2 and AirPods Max.

Apple launched the 2024 annual Worldwide Developers Conference (WWDC) event on June 10, 2024 at 10:00 AM PCT. Like in previous annual WWDC, and as reported in AroniSmart's previous coverages (AroniSmartIntelligence™ Technology: Ready for Apple's WWDC 2024 Event and AI Revolution) , the event focused on the future versions of iOS, iPadOS, macOS, watchOS, and tvOS and updates on the new innovation Vision Pro Headset. But there was even a more new uncovered plan: Apple Intelligence focusing Artificial Intelligence (AI). The major announcements included the new macOS 15, known as MacOS Sequoia, which is replacing macOS Ventura, iOS 18, iPadOS 18, tvOS18, watchOS11, visionOS 2 and more.

On Monday, June 10-14 , 2024 starting at 10 a.m. Pacific Time, Apple, Inc ( AAPL ) will hold the annual Apple Worldwide Developer Conference, or WWDC. The event is held every June at Apple's Apple Park spaceship in Cupertino, California. The event is the stage for Apple's numerous software platforms, including the new versions of iOS, iPadOS, macOS, tvOS, and watchOS.

Meanwhile, Apple stock price has been on a rollercoaster, reaching high levels, fueled by Artificial Intelligence (AI) dynamics and plans.

Lithium, a critical component in electric vehicle batteries, is in high demand. The demand for lithium has been rising, as the share of electric vehicles has been increasing. In fact, major dominating technology companies in the last five years include those leveraging electric cars and new batteries. However, the market for battery-grade lithium is way larger, beyond Electric vehicles. In fact most of portable electronics, the laptops and tablets and smartphones depend lithium-ion batteries. The key major player for Lithium production is the African continent. Hence, the question iis whether Africans, especially leaders are ready?

As expected Apple held its 2023 annual Fall event on Tuesday, September 12, 2023, starting at 10:00 AM PT. During the event, the new products long rumored were all confirmed, including iPhone 15, Apple Watch Series 9, and some accessories such as iPhone Cases, Apple Watch bands , USB-C, AirPods Pro Case (see previous articles here: AroniSmartIntelligence™ Technology: Ready for Apple's Wonderlust Event and Apple's Fall 2023 Event: iPhone 15, Apple Watch 9, iOS17, iPadOS17, tvOS17, watchOS 10, and More).

Apple is expected to hold its 2023 annual Fall event on Tuesday, September 12, 2023. During the event, it has been rumored that Apple will announce new products including iPhone 15, Apple Watch Series 9, and some accessories such as iPhone Cases, Apple Watch bands , and USB-C AirPods Pro Case. The event will build on the 2023 annual Worldwide Developers Conference (WWDC) launched on June 5, 2023. WWDC 2023 focused on the future versions of iOS, iPadOS, macOS, watchOS, and tvOS, and a captivating new innovation, Vision Pro Headset, operated by visionOS.

Big Tech Companies have been engaged on the road to Artificial Intelligence. The technology focus have been shifting from Machine Learning to Generative Artificial Intelligence (AI). Some technology companies have been publicly announcing their plans, including hiring engineers, statisticians, mathematicians, designers, and others with a background or interest in Machine Learning but pushing further to Generative AI. The move to Generative AI is a major step in AI itself. As they shape its strategy, advance their plans, achieve their goals, and reach their vision in AI, the expected windfalls are humongous . Already, some companies like META, Apples, and most recently NVIDIA have started to harvest the results.

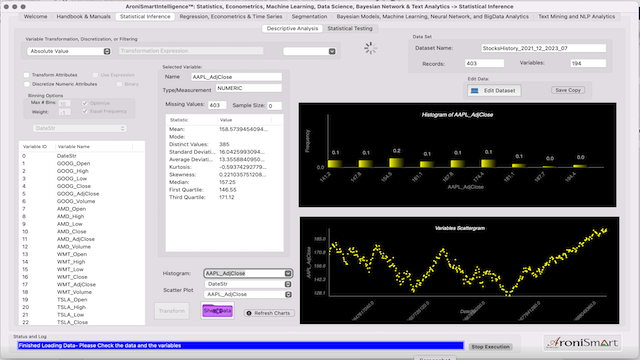

Stocks across all sectors, especially in Tech, Healthcare, Financial Services, Energy, and Consumer have been delivering differential returns over the last years including in 2021, 2022, and Q1- early Q4 2024. Most stocks reached heights in December 2021. Then, in 2022 and up to mid-Q1 2023, the stock growth became broadly negative across most sectors, except energy. The major stock market indices were also impacted. Since then, many stocks across all sectors, along with the key market indices have been on the rise, on a path to reaching the 2021 levels. In a sample of key stocks to watch, as identified by AroniSmart™ team, leveraging the Machine Learning, Econometrics, and NLP capabilities AroniSmartIntelligence™ and AroniSmartInvest™, most stocks have shown resilience and sometimes outperforming most of the other stocks and the key stock market indices. As the end of Q4 2023 is reached , almost all the stocks, along with the key indices have reached highs, even aiming at their record highs.

AroniSmart™ team, leveraging the Machine Learning Time Series capabilities, including Support Vector Machine, and Dominance Analysis of AroniSmartIntelligence™ and AroniSmartInvest™, has looked at the trends of the stock prices of 21 selected companies between Q4 2021 and Q4 2023 and came up with insights and projections on the dynamics. This is the Part 2 of the analysis. The findings captured in Part 1 may be seen here: AroniSmartIntelligence™ in Action: Stock Performance Analysis with Sentiment Analysis, Support Vector Machine and Dominance Analysis in Q4 2023 - Part 1.

Part 2 insights are presented below (for disclaimer and terms, check AroniSoft website).

Stocks across sectors, especially in Tech, Healthcare, Financial Services, Energy, and Consumer have been delivering differential returns over the last years including in 2021, 2022, and Q1- early Q4 2024. Most stocks reached their record highs in December 2021. Then in 2022 and up to mid-Q1 2023, stock growth has become broadly negative across most sectors, except energy. The major stock market indices were also impacted. Since then, many stocks across all sectors, along with the key market indices have been on the rise, trying to reach the 2021 levels. A sample of key stocks to watch, as identified by AroniSmart™ team, leveraging the Machine Learning and NLP capabilities of AroniSmartIntelligence™ and AroniSmartInvest™, have shown resilience and sometimes outperforming most of the stocks and the stock market indices.

The stock market lost momentum since December 2021 while the oil industry has gained following the increasing market volatility, inflation, interest rates, world events, and other dynamics. AroniSmart™ team, leveraging the Machine Learning Time Series capabilities, including Support Vector Machine, Econometrics, and Dominance Analysis of AroniSmartIntelligence™ and AroniSmartInvest™, has looked at the trends of the stock prices of 21 selected companies between Q4 2021 and Q4 2023 and came up with insights and projections on the dynamics. The insights are presented below (for disclaimer and terms, check AroniSoft website).

Stocks across industries have been experiencing an upward momentum since the beginning of Q3 2023. Some stocks have completely recouped the losses and reached their high levels observed in 2022. Technology, Beverages, and Semi-conductors stocks including Apple Inc. (NYSE: AAPL), Meta (NYSE: META), Nvidia (NYSE: NVDA), Advanced Micro Devices(AMD), Tesla(NYSE :TSLA), The Home Depot (NYSE: HD), Lowes (NYSE: LOW), Pepsi Cola (NYSE: PEP) and Exxon (NYSE: XOM) have been delivering strong returns in Q3 2023, similar to those in the year 2021 and Q1 2022. The oil industry has remained resilient during the period, with Crude Oil (CL=F) and Exxon Mobil Corporation (XOM) around the levels reached in late 2022. Banking and Pharmaceuticals stocks have remained almost flat or experienced some headwinds. The stock market indices have shown similar trends and patterns. The stock market appears to face off the previous increasing market volatility, inflation, world events, and other dynamics since late Q2 2022. AroniSmart™ team, leveraging the Machine Learning Time Series capabilities, including Support Vector Machine, and Dominance Analysis of AroniSmartIntelligence™ and AroniSmartInvest™, has looked at the trends of the stock price of AAPL vs the stock prices of 20 selected companies and market indices between Q4 2021 and Q3 2023 and came up with insights and projections on the dynamics. The insights are presented below (for disclaimer and terms, check AroniSoft website).

On Tuesday January 31, 2023, AroniSmart™ team, leveraging the NLP, Text and Sentiment Analysis, Machine Learning Econometrics and Time Series capabilities and Dominance Analysis of AroniSmartInvest ™ and AroniSmartIntelligence™, looked at the stock markets news and trends. Since the beginning of the year, the stock market has been volatile, with seesaw movements driven by the news around the world, the fears of recession, the resilience or weaknesses of some sectors, the inflation worries, Ukraine wars, Chinese companies, and economical forecasts. From the analysis, the team came up with insights and highlights on key stocks and market sentiments.

AroniSmartIntelligence Stock Market Indices Time Series Support Vector Machine, Neural Network and NLP Sentiment Analysis

Year 2022 is ending. During the year, the stock market has experienced major dynamics, mostly with historical randomness and a downtrend rollercoaster. The major upbeats sentiments and performance observed in 2021 were almost washed out. The main drivers have been inflation, Federal Reserve interest rates actions, international politics, including the war in Ukraine and the dynamics in the Chinese economy and US economic policies. In early Q4 2022, the stocks rose, in anticipation of a softening inflation following the rise in interest rates, some positive earnings ahead and softening worries of recession. But the volatility has remained high, driven by continued worries of recession and recent dynamics in tech companies, including layoffs, persistent inflation in some sectors, and slowing down growth in others. The S&P 500, DOW, NASDAQ, Russell 2000, Crude Oil, Silver, Treasury Yield, Gold all have been impacted and went though major volatilities. Hence the picture of the year, as the year is ending has been historic: a widespread volatility and growing fears after a fueled momentum over 2021. As highlighted in several analyses, major questions coming from investors and users leveraging AroniSmartIntelligence™ and AroniSmartInvest™ capabilities remain focused on the findings from analyzing the connection among the key Stock market indices, especially NASDAQ Dow Jones(DJI), S&P 500, Russell 2000, Gold, Silver, Treasury Yield and Oil and some key stocks, generating some meaningful trends. Based on these questions, AroniSmart™ team, has continued to leverage the advanced analytics tools to analyze the trends of the key market indices and a few selected stocks across some sectors, such as Technology, Finance, Retail, Healthcare, and others as the year 2022 ends. The key findings are captured in this article.

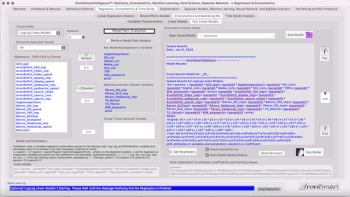

A/B Bayesian Testing is a new capability implemented in version 15.x of AroniSmartIntelligence™ available on Apple's App Store® (see the introduction and background on A/B Test in AroniSmartIntelligence™ here). A/B Testing is a statistical methodology that involves randomly splitting an experiment into two groups with the goal to find what works better. For example, in digital marketing where the objective is to test which version of a banner, an e-mail, or a web page leads to a higher conversion rate, a user base is split into two groups. Each of the two groups is showed a different version of the web page, an app, or an e-mail. The goal is to see if the modified version has a higher impact on user behavior, conversion rates, increased sales, etc. A/B testing has become a key analytical methodology in machine learning and data science across industries, in the technology in general, given its effectiveness to help test hypotheses and get reliable analytics to support better informed decision making and drawing conclusions about any numerical data driven hypotheses.

AroniSmartIntelligence ™ is one of the most advanced analytics tools with Machine Leaning, Data Science, Statistics, Econometrics, NLP Text and Sentiment analysis, Neural Network, and Support Vector Machine capabilities. To support Hypothesis Testing, Design and Analysis of experiments, Marketing Campaign and Digital Marketing Assets Analyses, and Marketing Mix analysis, a new capability has been added to the new version 15.x of AroniSmartIntelligence ™: A/B Bayesian Test. Hence, the new AroniSmartIntelligence version will also include the critical capability. complementing the usual frequentist hypothesis testing and statistical inference tools.

A/B testing has become a key analytical methodology in machine learning and data science across industries, in the technology in general, given its effectiveness to help test hypotheses and get reliable analytics to support better informed decision making and drawing conclusions about any numerical data driven hypotheses.

On Tuesday May 30, 2023, AroniSmart™ team, leveraging the NLP, Text and Sentiment Analysis, Machine Learning Econometrics and Time Series capabilities and Dominance Analysis of AroniSmartInvest ™ and AroniSmartIntelligence™, looked at the stock markets news and trends. Since the beginning of the year, the stock market has been volatile, with seesaw movements driven by the news around the world, the fears of recession, the resilience or weaknesses of some sectors, the inflation worries, Ukraine wars, Chinese companies, and economical forecasts. From the analysis, the team came up with insights and highlights on key stocks and market sentiments. Below are the key stocks highlighted and expected to weight heavily in investment decisions at the end of Q2 2023 and the associated sentiment analysis results.

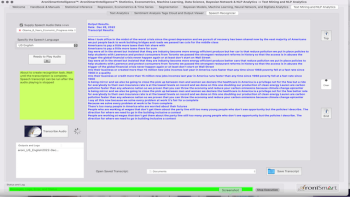

AroniSmartIntelligence ™ is one of the most advanced analytics tools with Machine Leaning, Data Science, Statistics, Econometrics, NLP Text and Sentiment analysis, Neural Network, and Support Vector Machine capabilities. To support NLP Text and Sentiment analysis, a new capability has been recently added: Speech-to-Text Transcription. Now the AroniSmartIntelligence version will also include a critical capability: Decision Trees, complementing the usual Bayesian Network and Regression classification tools.

Decision Trees will help solve the various problems related to classification built on big data and fuel data science insights.

AroniSmartIntelligence ™ is one of the most advanced analytics tools with Machine Leaning, Data Science, Statistics, Econometrics, NLP Text and Sentiment analysis, Neural Network, and Support Vector Machine capabilities. Many users have been asking questions on how to use the tool for some key modeling needs. One of the increasing predictive modeling needs focus Marketing Mix Analytics (MMx) and Multi Touch Attribution (MTA).

The following sections covers the approach to use AroniSmartIntelligence to build the two types of models: MMx and MTA.

AroniSmartIntelligence ™ is one of the most advanced analytics tools with Machine Leaning, Data Science, Statistics, Econometrics, NLP Text and Sentiment analysis, Neural Network, and Support Vector Machine capabilities. To support NLP Text and Sentiment analysis, a new capability has been added: Speech-to-Text Transcription.

AroniSmartIntelligence Speech Recognition and Transcription is being added to address key requirements and meet the needs for more advanced NLP Text and Sentiment analytics.