In Q1 2025, Stocks across industries have continued to experience, yet, a resilience. The trend was built on the dynamics of Q3 - Q4 2024. Hence, the market has continued to remain on the foundations of Q4 2024, which overtook the challenges in mid Q2 2024, when all the key market indices, including Crude Oil (CL=F) and 10-Yr Bond (^TNX), declined from the top reached in late July 2024. By mid Q1 2025, the gains observed in Q4 2024 have continued to hold. The current levels appear to continue to be driven by the diminishing challenges and world expectations following the US elections, which led to the stocks and indices pushing through Q4 2024 with a significant improvement in performance. Hence, since Q4 2024, the stock market adjusted to the previous dynamics that have been leading to increasing market volatility, including inflation, world events, and other challenges that started in late Q2 2022 and in October 2023 and showed up again in Q3 2024 . The US elections in 2024 appears to have a limited impact on the dynamics. Hence, the performance and factors in the end of year 2024 remain the main drivers of the persistence. On February 17, 2025, AroniSmart™ team, leveraging the NLP, Text and Sentiment Analysis, Machine Learning Econometrics and Time Series capabilities and Dominance Analysis of AroniSmartInvest ™ and AroniSmartIntelligence™, looked at the stock markets news and trends.

The period of Q4 2024 was marked by records performance, following the downward trends in mid Q3 2024. Early Q1 2025 has been marked by strong resilience, despite complex dynamics driven by the current market factors, including the wars around the World, the last US elections and political dynamics, continued inflation and interest rates, and unpredictable earnings seasons.

The stock market has experienced an upward momentum during Q4 2024 starting with mid Q3 2024. However, starting with the first week of Q1 2025, the levels reached have been held. The resilience appears to be driven by the expected world challenges with impact on Oil prices, technology, inflation, consumer confidence, and the projections following the earnings reports. These expectations did not appear tp significantly impact the stock indices. Then, starting with Dec 2024, the stocks have remained stable and almost all indices have kept the levels reached Q4 2024.

Hence, trend-wise, since Jan 2025 and pushing through mid Q1 2025, the indices, although experiencing seesaw periods, have maintained their levels, with upward trends. Their performances are as follows Year-to-Date (YTD) and since the end of February 2024 as of February 14, 2025:

- NASDAQ Composite (^IXIC): 3.71% and 26.28%;

- Dow Jones Industrial Average (^DJI): 4.71% and 15.93%;

- S&P 500 (^GSPC): 3.96% and 22.28%;

- Crude Oil index (CL=F): 0.56% and -9.85%;

- Russell 2000 (^RUT): 2.34% and 16.08%;

- Gold Mar 25 (GC=F): 11.71% and 44.73%;

- Silver Mar 25 (SI=F): 12.95% and 40.26%;

- CBOE Interest Rate 10 Year T No (^TNX): -2.21% and 4.80%;

- Chicago Board Options Exchange's CBOE NASDAQ 100 Volatility Index: -9.49% and -1.26%;

Since mid January 2025, the performance among the market indices has been overall significantly rising, with Dow Jones Industrial Average (^DJI) by 4.77%, Nasdaq (^IXIC) by 13.26%, S&P 500 (^GSPC) by 4.65% , and the Russel 2000 (^RUT) by 16.13%.

At the beginning of the year 2024 the inflation seemed to be receding, the job market looked like slowing down, and the fears of recession focused on a slow soft landing. Hence, the expectations of the Federal Reserve ending the rate hikes and moving to cutting the rates were very high. The interest rate cuts were expected to sustain the stability of the market, as companies seemed ready to cut the costs of borrowing and to sustain profitability. However, the inflation upward trend has continued to be a worry and the job market has maintained its strength. Hence the Federal Reserve only cut of interest rates three times, including 25 basis point cuts in November and December, as follows:

September 2024: 50 basis points, from 5.25%–5.5% to 4.75%–5.00%. This was the first interest rates cut in over four years.

November 2024: 25 basis points, from 4.75%–5.0% to 4.50%–4.75%

December 2024: 25 basis points, lowering the target interest rate range to 4.25%–4.50%.

Even though the interest cuts were not as many or higher as expected, the market remained resilient, even though still strong job market and the expectations for the Federal Reserve to pause the cuts of the interest rates, and maybe leaning towards resuming the rates at least three months after the elections or even in mid to late 2025 at the latest.

Meanwhile, as highlighted in 2024 analyses by AroniSmart™ Team, Big Tech Companies have accelerated on the road to Artificial Intelligence, focusing on Generative Artificial Intelligence (AI) and improving their Machine Learning capabilities (see AroniSmart™ Tech: Race for Artificial Intelligence (AI) Among Big Tech Companies Gaining Momentum - NVIDIA, APPLE, META, ALPHABET, AMD, INTEL. Let Us Revisit AI). Over Year 2024 and in Q1 2025, most of these Big Tech companies like META, APPLE, NVIDIA, AMD, INTEL, and others have continued to harvest the results.

The results of the analysis using both AroniSmartIntelligence™ and AroniSmartInvest™ are below:

Advertisement

GET ARONISMARTINVEST, A LEADING INVESTMENT RESEARCH TOOL, BASED ON Advanced Analytics, machine Learning and Data Science on App Store -- click here

Dynamics and Trends in Mid Q1 2025.

The key findings highlight: Most of the stocks highlighted in 2024 analyses have continued to drive the dynamics throughout Q4 2024 and through mid-Q1 2025. Most maintained their upward trend and overall significant increase after a decline or a flat performance in the middle of Q2 2024 and the middle of Q3 2024.

Trend wise, the challenges in the mid-Q2 2024, were faced and the market dynamics fueled the upward trend in Q4 2024 and in as of mid-Q1 2025 they remained at the levels reached in Q4 2024.

The insights below are based on the data as of February 15, 2025. AroniSmart™ team will continue to update detailed analyses.

Fig 1-a: AroniSmartInvest Modules

Fig 1 -b: AroniSmartIntelligence Modules

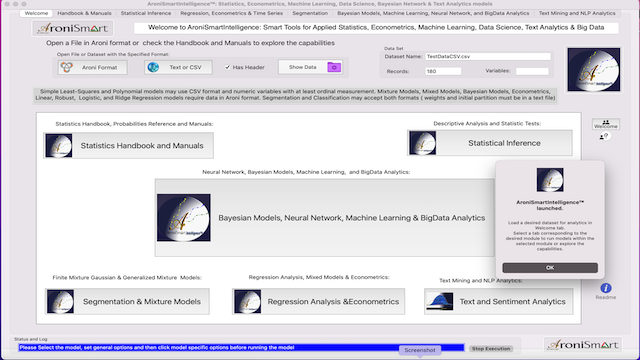

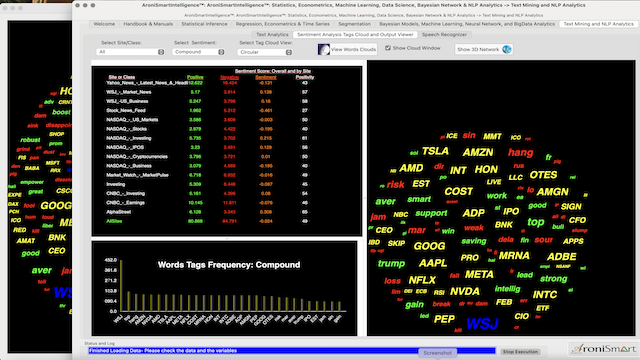

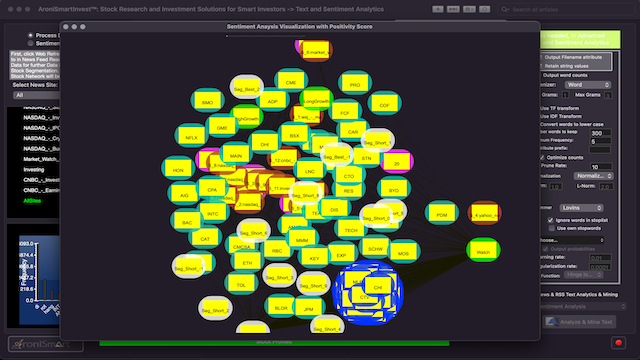

Fig 2-a: Market Profile, Key Stocks to Watch and Frequent Word Tags

Fig 2-b:Market Profile: Positivity, Key Stocks to Watch, and Word Tags

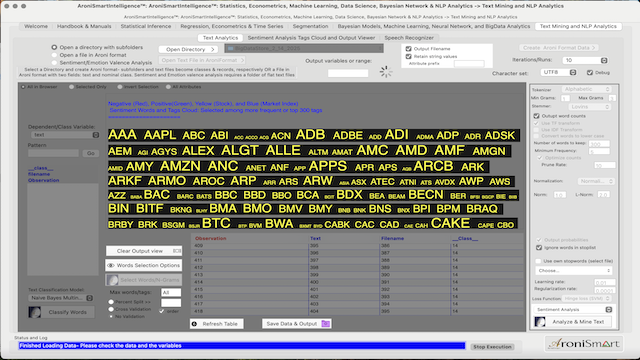

Fig 3-a: Key Stocks to Watch A-C

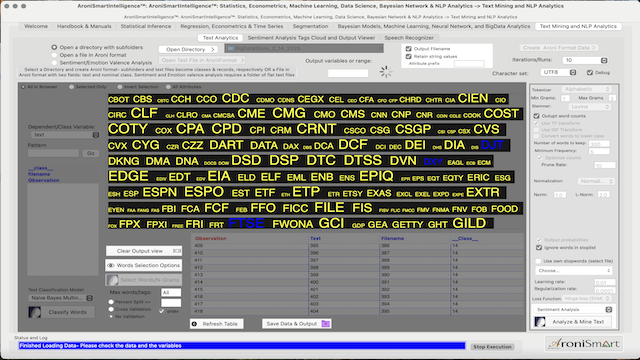

Fig 3-b: Key Stocks to Watch C-G

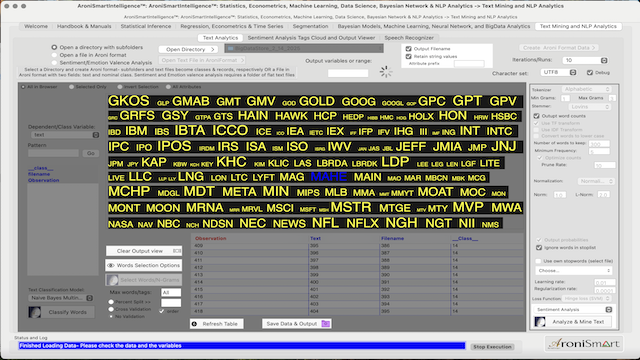

Fig 3-c: Key Stocks to Watch G-N

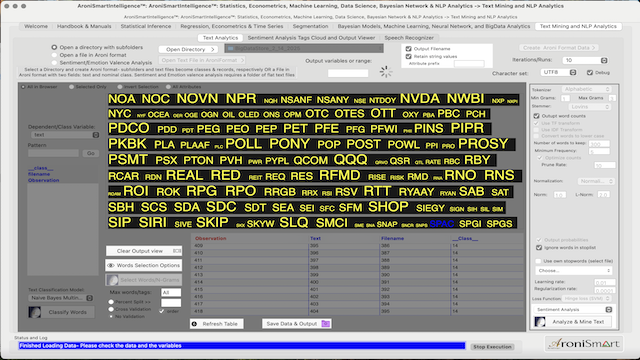

Fig 3-d: Key Stocks to Watch N-S

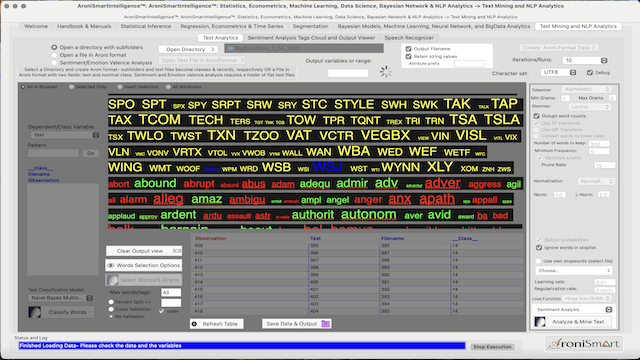

Fig 3-e: Key Stocks to Watch S-Z and Tags A

Advertisement

GET ARONISMARTINTELLIGENCE on App Store

AroniSmartIntelligence, the leading tool for Advanced Analytics, Machine Learning & Data Science

Statisticians, Data Scientists, Business and Financial Analysts, Savvy Investors, Engineers, Researchers, Students, Teachers, Economists, Political Analysts, and most of the practitioners use Advanced Analytics to answer questions, to support informed decision making or to learn.

AroniSmartIntelligence™ is a leading Advanced Analytics, Machine Learning and Data Science tool, with optimized cutting edge Statistics models, Econometrics, Big Data and Text Analytics.

AronismartIntelligence™ includes modules covering Machine Learning and Big Data mining, Unstructured Text Analysis, Sentiment and Emotion Analytics, Bayesian Statistics and other advanced analytics.

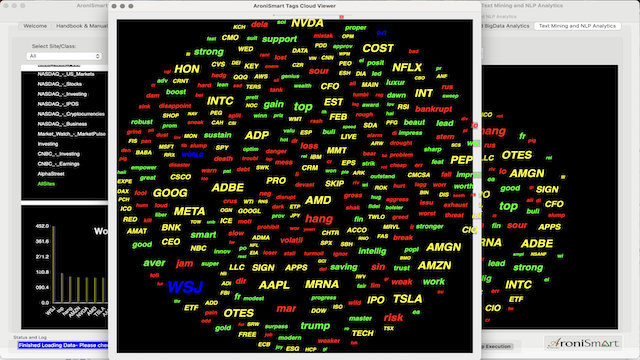

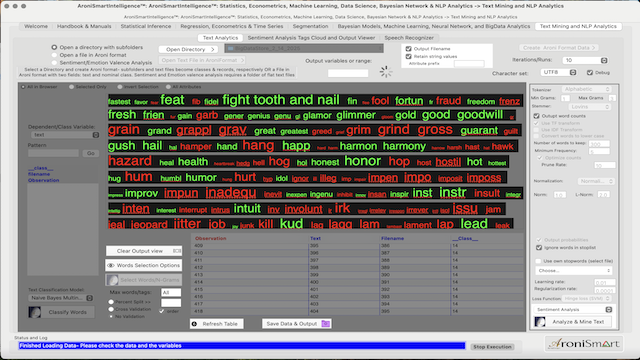

NLP Sentiment Analysis: Key Word Tags

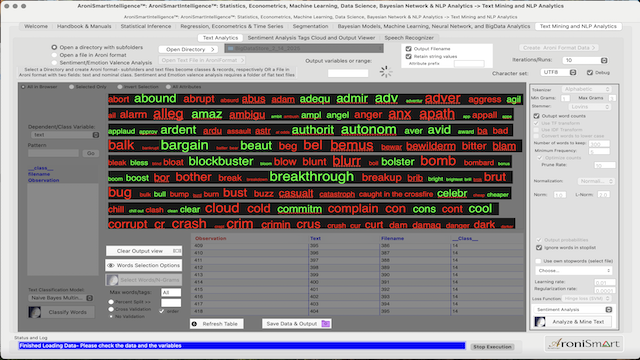

Fig 4-a: Sentiment Analysis: Key Word Tags A - C

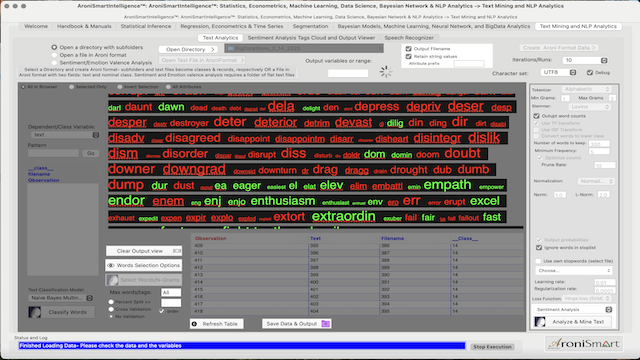

Fig 5-a: Sentiment Analysis: Word Tags C - E

Fig 5-b: Sentiment Analysis: Word Tags F - K

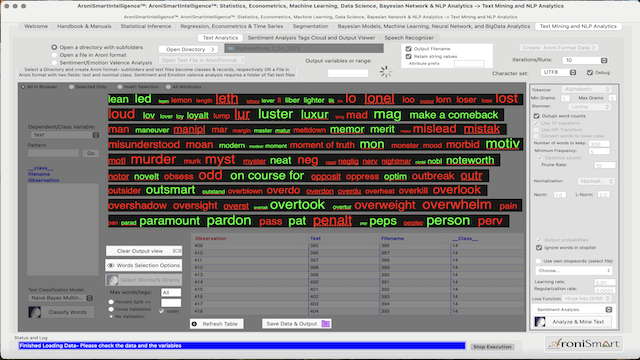

Fig 5-c: Sentiment Analysis: Word Tags L - P

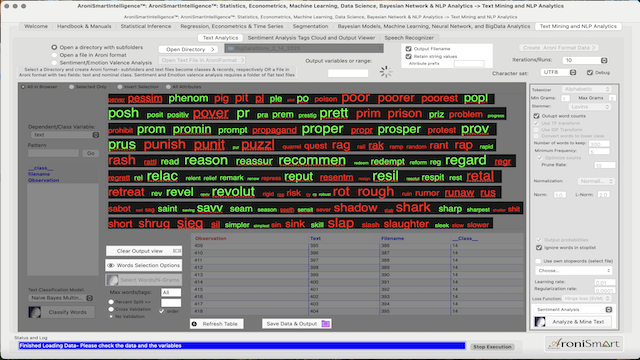

Fig 5-d: Sentiment Analysis: Word Tags P - S

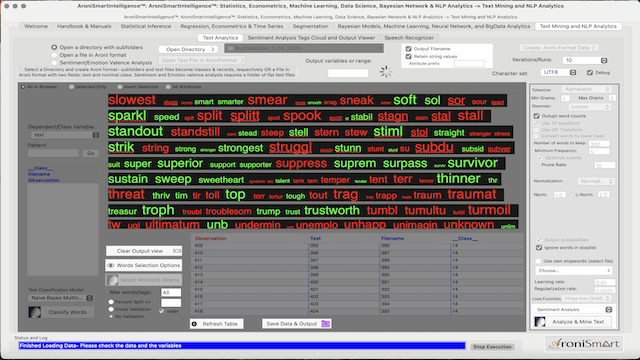

Fig 5-b: Sentiment Analysis: Word Tags S - U

Bayesian Modeling and NLP analysis: Stocks to Watch and High, Short, and Long Term Growth Stocks

Fig 6-a: Stocks Bayesian Network View: Watch, High Performing and Short Growth

More detailed analyses can be conducted using AroniSmartIntelligence™ Big Data, Machine Learning, Time Series and Sentiment Analysis capabilities.

For more on AroniSmartIntelligence and AroniSmartInvest capabilities, visit AroniSoft web site by clicking here. AroniSmartInvest™ and AroniSmartIntelligence ™ are available on Apple's App Store.

©2025 AroniSoft LLC

Advertisement

GET ARONISMARTINTELLIGENCE™ on App Store

AroniSmartIntelligence™, the leading tool for Advanced Analytics, Machine Learning & Data Science

Statisticians, Data Scientists, Business and Financial Analysts, Savvy Investors, Engineers, Researchers, Students, Teachers, Economists, Political Analysts, and most of the practitioners use Advanced Analytics to answer questions, to support informed decision making or to learn.

AroniSmartIntelligence™ is a leading Advanced Analytics, Machine Learning and Data Science tool, with optimized cutting edge Statistics models, Econometrics, Big Data and Text Analytics.

AronismartIntelligence™ includes modules covering Machine Learning and Big Data mining, Unstructured Text Analysis, Sentiment and Emotion Analytics, Bayesian Statistics and other advanced analytics.

Advertisement

Get the following books on Amazon:

Legs of Tornado: The Human Who Outran the Wind, an African tale about a human from a humble upbringing who outran the wind, defeated evil spirits, overcame his fate, became a respected clan chief, and triumphed ever after.

Click Here to Get the books: Even Roosters Dream to Fly and Legs of Tornado

Even Roosters Dream to Fly along with Legs of Tornado are also available on Amazon worldwide and soon on several other platforms:

For more on the book, the author, the inspiration of the stories, Visit the author website here

Check the Book Video trailer of Even Roosters Dream to Fly, here