In mid Q3 2022, the the stock market has been experiencing new dynamics. After the high volatility mixed with some positive trends observed in July 2022, positive trends have persisted . On July 26, 2022, AroniSmart™ team, leveraging the NLP, Text and Sentiment Analysis, Machine Learning, Data Science, Time Series and Support Vector Machine capabilities and Dominance Analysis of AroniSmartInvest ™ and AroniSmartIntelligence™ tools, looked at the stock market news and trends. The volatility of the stock market had continued, with mixed trends and both national and worldwide events and economic situation continued to drive the market dynamics, with the key indices in seasaw movements, some with signifcant negative trends . On August 13, 2022 AroniSmart™ team updated the analysis. From the latest analysis, the team has come up with insights and highlights on key stocks and the market sentiment driving the dynamics of the stock market by mid Q3 2022.

Key Insights based on AroniSmart Analysis

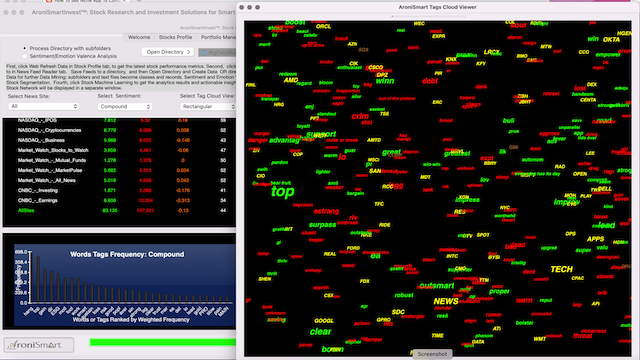

The dynamics in mid-Q3 2022 have changed, with positive trends and improvements of all key market indices, except Crude Oil. In previous analyses, the dynamics observed since late Q1 2022 - early Q2 2022 were the main drivers of the persistent, and at times worsening, volatility of the stock market. The factors captured in the Machine Learning of sentiment analysis remain the persistent inflation, Federal Reserve Bank interest rates policies, Russia-Ukraine war, the worries about China's economy, and the projected economic performance of major corporations. In the new analysis, the data on the softening inflation, the impact of Federal Reserve Bank interest rates policies, and decreasing worries about the Russia-Ukraine war and China's economy have fueled the market.

The insights based on the latest analysis are telling. Although the sentiment positivity remains below 50, the news on economy and the latest policy decisions appear to have negated the overall worries about the upcoming recesssion. The dynamics in the stock market have positively impacted all the stock market indices. In one month, the indices have peformed as follows:

- S&P 500(^GSPC): +12.08%

- DOW 30 (^DJI): +8.97%

- NASDAQ (^IXIC): +15.82%

- RUSSELL 2000 (^RUT): +18.59%

- Crude Oil Sep 22 (CL=F)": - 22.34%

Since early July 2022, the U.S. stock prices seem to persist on a momentous bounce back, after historical losses, despite some periods of being dragged down. The previous analyses by AroniSmart Team highlighted the fact that, until recently, the stock market bottom reached in 2020 was believed to be the worst, before, at some point, the U.S. stocks experienced historical weekly losses, with Dow Jones suffering the longest losing streak in recent history, apparently the worst since 1932.

The analyses also highlighted the probability of a market stabilization over Summer, despite persistent deep uncertainties and the fears of a recession. The current analysis shows that the new trends in August may validate these high probabilities of temporary stabilization.

Advertisement

Get the following books on Amazon:

Legs of Tornado: The Human Who Outran the Wind, an African tale about a human from a humble upbringing who outran the wind, defeated evil spirits, overcame his fate, became a respected clan chief, and triumphed ever after.

Click Here to Get the books: Even Roosters Dream to Fly and Legs of Tornado

Even Roosters Dream to Fly along with Legs of Tornado are also available on Amazon worldwide and soon to several other platforms:

For more on the book, the author, the inspiration of the stories, Visit the author website here

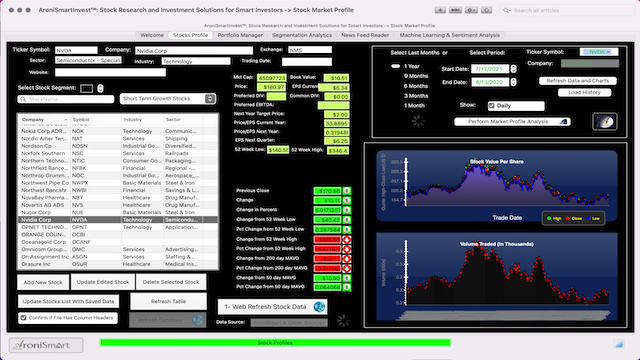

In the analysis as of early July, 2022, AroniSmart stock segment analysis had shown that, for all the segments, the following changes were negative: changes from 52 week high, changes from 50 days, and changes from 200 days. In the previious analysis, the changes from 50 days had become positive, confirming the positive trends over the first three weeks of July 2022. In the current analysis, the following changes are mostly positive: changes from 52 week low, changes from 50 days, and changes from 200 days.

The example of the stock price trend of AstraZeneca (NVDA) highlights the finding.

Findings from AroniSmartIntelligence and AroniSmartInvest.

Below are the key stocks highlighted and expected to weight heavily on investment decisions and the associated sentiment analysis results.

Figure 1: AroniSmartIntelligence Sentiment Analysis and Stocks - August 13 2022 - Market Profile for AZN

Figure 2: AroniSmartIntelligence Sentiment Analysis Stocks - August 13 2022 - Stocks Segmentation: Changes in prices and technicals.

Figure 3: Market Profile: High Performing and Short Growth Stocks - Sample

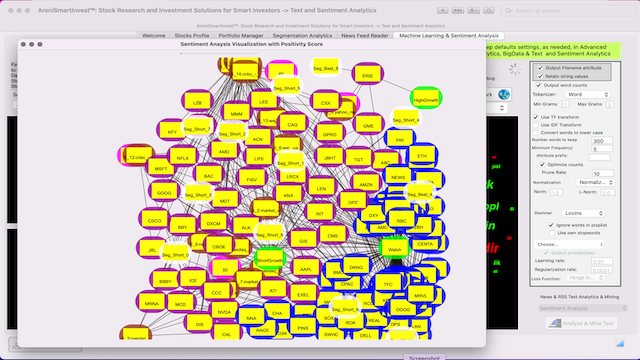

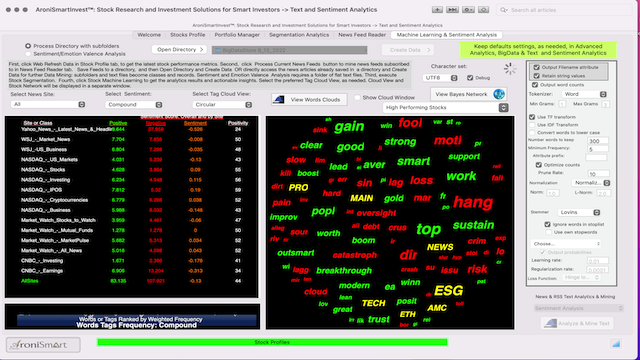

Figure 4 : AroniSmartIntelligence Sentiment Analysis and Word Tags - August 13 2022

Figure 5: AroniSmartIntelligence Sentiment Analyisis Stocks and Word Tags and Positivity - August 13 2022

Figure 6: AroniSmartIntelligence Sentiment Analysis Stocks to Watch A - D- August 13 2022

Figure 7: AroniSmartIntelligence Sentiment Analysis Stocks to Watch A - D - August 13 2022

Figure 8: AroniSmartIntelligence Sentiment Analysis Stocks to Watch D - Z - August 13 2022

More detailed analyses can be conducted using AroniSmartIntelligence™ and AroniSmartInvest™ Big Data, Machine Learning, Time Series and Sentiment Analysis capabilities.

For more on AroniSmartIntelligence™ and AroniSmartInvest™ capabilities, visit AroniSoft web site by clicking here. AroniSmartInvest™ and AroniSmartIntelligence ™ are available on Apple's App Store.

Advertisement

GET ARONISMARTINTELLIGENCE on App Store

AroniSmartIntelligence, the leading tool for Advanced Analytics, Machine Learning & Data Science

Statisticians, Data Scientists, Business and Financial Analysts, Savvy Investors, Engineers, Researchers, Students, Teachers, Economists, Political Analysts, and most of the practitioners use Advanced Analytics to answer questions, to support informed decision making or to learn.

AroniSmartIntelligence™ is a leading Advanced Analytics, Machine Learning and Data Science tool, with optimized cutting edge Statistics models, Econometrics, Big Data and Text Analytics.

AronismartIntelligence™ includes modules covering Machine Learning and Big Data mining, Unstructured Text Analysis, Sentiment and Emotion Analytics, Bayesian Statistics and other advanced analytics.

For More on AroniSoft LLC and AroniSmart products click here

For More on the latest version of AroniSmartIntelligence and AroniSMartInvest.

AroniSmartIntelligence™: Optimized Machine Learning, Advanced Analytics, and Data Science Capabilities Including Econometrics, Bayesian Models, Neural Network Models, Marketing Mix Models, and NLP Analytics

@2022 AroniSoft LLC