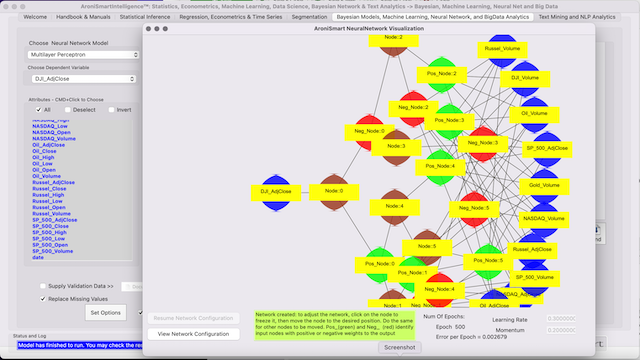

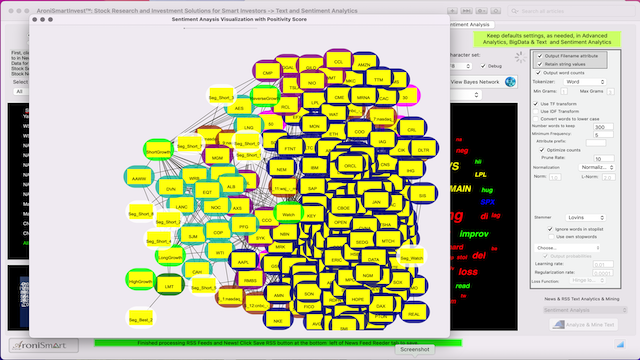

AroniSmartIntelligence Stock Market Indices Time Series Support Vector Machine, Neural Network and NLP Sentiment Analysis

Year 2022 is ending. During the year, the stock market has experienced major dynamics, mostly with historical randomness and a downtrend rollercoaster. The major upbeats sentiments and performance observed in 2021 were almost washed out. The main drivers have been inflation, Federal Reserve interest rates actions, international politics, including the war in Ukraine and the dynamics in the Chinese economy and US economic policies. In early Q4 2022, the stocks rose, in anticipation of a softening inflation following the rise in interest rates, some positive earnings ahead and softening worries of recession. But the volatility has remained high, driven by continued worries of recession and recent dynamics in tech companies, including layoffs, persistent inflation in some sectors, and slowing down growth in others. The S&P 500, DOW, NASDAQ, Russell 2000, Crude Oil, Silver, Treasury Yield, Gold all have been impacted and went though major volatilities. Hence the picture of the year, as the year is ending has been historic: a widespread volatility and growing fears after a fueled momentum over 2021. As highlighted in several analyses, major questions coming from investors and users leveraging AroniSmartIntelligence™ and AroniSmartInvest™ capabilities remain focused on the findings from analyzing the connection among the key Stock market indices, especially NASDAQ Dow Jones(DJI), S&P 500, Russell 2000, Gold, Silver, Treasury Yield and Oil and some key stocks, generating some meaningful trends. Based on these questions, AroniSmart™ team, has continued to leverage the advanced analytics tools to analyze the trends of the key market indices and a few selected stocks across some sectors, such as Technology, Finance, Retail, Healthcare, and others as the year 2022 ends. The key findings are captured in this article.