On May 19, 2021, the stock market sentiment has started to head towards negativity, after a long period of positivity. In the analysis conducted by AroniSmart™ team on April 30, 2021, investors appeared to have started finding direction and answers on one of the key questions the market actors were facing: what is coming next? Although the answer to the question remained elusive, there appeared to be a growing consensus on where the market was heading, following the up and down movements, around an overall upward trend, observed since the beginning of the year. While the overall upward trend was observed since the beginning of the year, by late-April the trend has shifted downward. As of the closing hour of May 19, 2021 the dynamics of the stock market were different.

In the previous analyses, AroniSmart™ team had continued to look at the major positive signs at the start of Q2 2021, building on the volatility dynamics observed in early April, March and February 2021, (see some dynamics here: AroniSmartInvest™ in Action: New Trends and Key Stocks on April 30, 2021; Machine Learning, Bayesian Network, Stock Segmentation, Market Sentiment Analyses).

On April 30, 2021 the stock market performance appeared to be impacted by factors similar to those that were driving the volatility as of April 2, 2021: speculative considerations on the economy, profit taking, bonds prices, interest rates, options trading, political agenda, and related news about some key stocks, especially those related to Electic Vehicules (EV) Technology, Solar Energy, Cryptocurrency, Retail, and Banking. Since then, earnings and inflation concerns have taken over.

As of the closing hour of May 19, 2021 the key stock market indices continued to register losses ( Dow Jones Industrial Average remains almost flat with a gain of 0.22%, Nasdaq lost 3.53 %, S&P 500 lost 0.47%). AroniSmart™ team, leveraging the Machine Learning, Big Data, Bayesian Network Analysis, Neural Network Analysis, Text Analytics and Sentiment and Valence Analysis capabilities of the new improved AroniSmartInvest™, and AroniSmartIntelligence™ looked at the stock performance, market sentiment index and events driving the stock market on May 19, 2021 ( For More on AroniSoft LLC and AroniSmart products click here).

AroniSmart™ team continues to build on earlier analyses in 2021. The analyses reinforce the fact that the market sentiment is in the negative territory, as investors appear to continue struggling with uncertainty and volatility and both upbeat expectations on some earnings and downbeat actions, due to inflation and other concerns.

Advertisement

GET ARONISMARTINVEST, A LEADING INVESTMENT RESEARCH TOOL, BASED ON Advanced Analytics, machine Learning and Data Science on App Store -- click here

A little bit of the insights on the market events and sentiments, from AroniSmart™ team's findings, based on the data as of May 19, 2021.

AroniSmart™ team analyzed the key stories, leveraging the Machine Learning, Big Data Bayesian Network Analysis, Neural Network Analysis, Text Analytics, and Sentiment and Valence Analysis capabilities of AroniSmartInvest™ and AroniSmartIntelligence™ and uncovered actionable insights..

General Market Events and Sentiments

The Market Sentiment is steadily shifting to negative territories across several sectors and sites. The news continue to focus on earnings for big companies such as Walmart (WMT), Target (TGT), and small companies. However, inflation, uncertian news on EV (electric vehicles), cryptocurrencies, chip shortages, and crowd investments continue to weight heavily. The performance of some of these stocks remains puzzling, especially those whose stock prices lost despite the fact that their earnings and sales beat expectations with a high margin. The analysis highlights multiple dynamics, for the stock profile, the segmentation of stocks, the market profile and the sentiment in general.

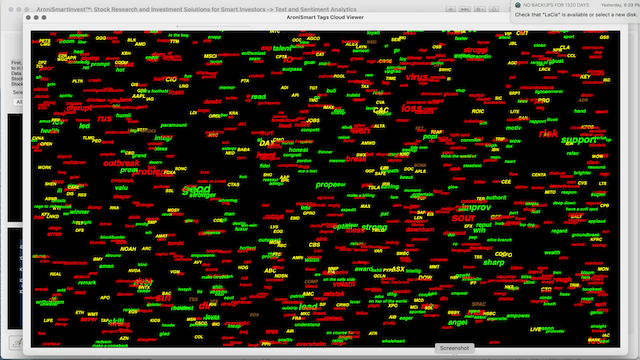

AroniSmartIntelligence™ Analysis of Positive and Negative Sentiment words.

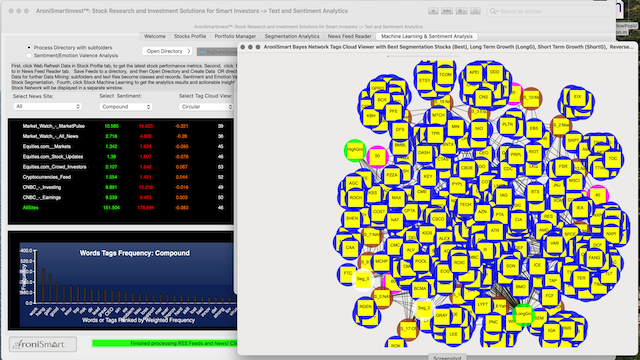

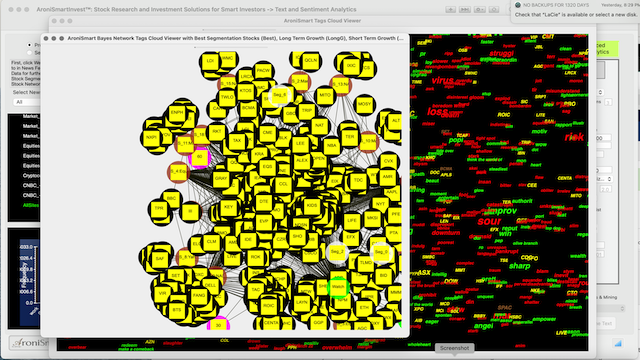

The sample screen shot below shows some of the key stocks tickers, with high overall index in the AroniSmartInvest Tags word cloud and Bayesian Network analysis, as of May 19, 2021. A more complete view may be produced using the Bayesian Network and Sentiment Analysis capabilities in the Machine Learning module or AroniSmartInvest or both the Neural Network and Bayesian Network capabilities of AroniSmartIntelligence™

From the figure above, it appears the Tech, Energy, Economy and Inflation related tags are prominent, highlighting the dominance of news about earnings, inflation, Tech companies challenges and employment. The dominance of Retail, Energy, Tech, Oil and Healthcare stocks and news related word tags remain dominant as expected.

As depicted in the complete Words Cloud and Tags view, for which a partial screen shot is given above, it was found that the positivity (see words in green) continues to be driven by words such as comeback, health, on course, support, improv, innov, interest, etc. The words cloud points to the continued improving companies earnings, healthcare, retail, oil energy , COVID-19 vaccinations, new innovations, Solar Energy, and the continued government support to improve economic performance.

The negativity continues to come from the market volatility, downturn, risk, rough, debt, and job market, and overal challenges related to uncertainties and risks while trying to overcome the last crisis, while avoiding potential pitfalls.

AroniSmartInvest™ in Action: Segmentation and Key Stocks Driving the Market Sentiment

The stock analysis continues to reinforce the earlier findings on the sectors driving the markets. The stocks include TECH, Retail, Banking, Healthcare, Energy and Transportation. Tech sector appears to have mixed results, whereas Healthcare, Retail, Transportation, Energy, and Banking maintain their upward momentum. In the current analysis, the optimal segmentation analysis continued to keep the 10 segments, with an additional bucket of outliers (-1), with different performance, in terms of technicals and fundamentals, with most TECH companies shifting to segments with decling momentum (see below).

The list of stocks highly impacted on May 30, 2021 has varied since the last analysis. TECH, Retail, Banking, chip, Energy, Car makers, and Retail companies have a high weight. Apple (AAPL), MicroSoft (MSFT), Johnson & Johnson (J&J), Tesla(TSLA), Amazon (AMZN), Moderna(MDNA), Pfizer(PFE), General Motors (GM), Exxon Mobil Corporation (XOM), Oracle(ORCL), Bank of America (BAC), JP Morgan Chase & Co (JPM), Walmart (WMT), AT&T (T), Cisco Systems(CSCO), Advanced Micro Devices, Inc. (AMD), NVIDIA(NVDA), etc... continue to drive the market and appear in the analysis. The Bitcoin and EV stocks also continue to play a major role. The figure below shows a sample of stocks in news in the High Growth and Short Term Growth groups, accross all the 10 identified segments, mostly mentionned in the news on May 19, 2021.

More detailed analyses, including stock segmentation and profile analysis can be conducted using Big Data, Machine Learning, Neural Network, Time Series and Sentiment Analysis capabilities of AroniSmartInvest and AroniSmartIntelligence™.

Advertisement

GET ARONISMARTINTELLIGENCE on App Store

AroniSmartIntelligence, the leading tool for Advanced Analytics, Machine Learning, Neural Network, & Data Science

Statisticians, Data Scientists, Business and Financial Analysts, Savvy Investors, Engineers, Researchers, Students, Teachers, Economists, Political Analysts, and most of the practitioners use Advanced Analytics to answer questions, to support informed decision making or to learn.

AroniSmartIntelligence™ is a leading Advanced Analytics, Machine Learning and Data Science tool, with optimized cutting edge Statistics models, Econometrics, Big Data and Text Analytics.

AronismartIntelligence™ includes modules covering Machine Learning and Big Data mining, Unstructured Text Analysis, Sentiment and Emotion Analytics, Bayesian Statistics and other advanced analytics.

@2021 AroniSoft LLC

For More on AroniSoft LLC andAroniSmart products click here