On May 19, 2021, the stock market sentiment had started to head towards negativity, after a long period of positivity. Almost a month later, the sentiment continues to lean towards negativity. As of the closing hour of June 11, 2021 the dynamics of the stock market remain complex and the sentiment neutral or negative.

In the previous analyses, AroniSmart™ team has been digging into the major positive signs at the start of Q2 2021, building on the volatility dynamics observed in early April, March, and February 2021 (see some dynamics here: AroniSmartInvest™ in Action: Machine Learning, Bayesian Network, Stock Segmentation, Market Sentiment Analyses Uncovers Key Stocks on May 19, 2021 ). However, unlike the situation as of the closing hour of May 19, 2021 where the key stock market indices continued to register losses or were flat, on June 12, 2021, the major indices were up (S&P 500 - ^GSPC: +0.19%; Dow 30 - ^DJI: 0.04%; Nasdaq Composite - ^IXIC :0.35%). All the indices were also significantly up for the month (May 12 - Jine 11, 2021). For the week, only Dow 30 was down.

AroniSmart™ team, leveraging the Machine Learning, Big Data, Bayesian Network Analysis, Neural Network Analysis, Time Series and Econometrics, Text Analytics and Sentiment and Valence Analysis capabilities of the new improved AroniSmartInvest™, and AroniSmartIntelligence™ looked at the stock performance, market sentiment index and events driving the stock market on June 12, 2021 and leading into the week of June 14-19, 2021 ( For More on AroniSoft LLC and AroniSmart products click here. See advertisment below to download free demo).

AroniSmart™ team continues to build on earlier analyses in 2021. The analyses reinforce the fact that the market sentiment is in the negative territory, as investors appear to continue struggling with uncertainty and volatility and both upbeat expectations on some earnings and downbeat actions, due to inflation and other concerns. Speculative considerations on the economy, public debt and political agenda, profit taking, bonds prices, interest rates, options trading, and related news about some key stocks, especially those related to Computer Chip Electic Vehicules (EV) Technology, Solar Energy, Cryptocurrency, Retail, and Banking remain the main drivers of the dynamics in the market.

Advertisement

GET ARONISMARTINVEST, A LEADING INVESTMENT RESEARCH TOOL, BASED ON Advanced Analytics, machine Learning and Data Science on App Store -- click here

FOR THE DEMO OF AN APPLICATION, PLEASE CLICK ON THE LINKS BELOW TO DOWNLOAD COMPRESSED APPLICATION PACKAGES (OS X VERSION):

On a Mac, Control-click on the link and choose “Download Link As…” to save the document to your computer. Uncompress and run the application. Make sure the settings allow running an application downloaded from the Internet.

A little bit of the insights on the market events and sentiments, from AroniSmart™ team's findings, based on the data as of June 12, 2021.

AroniSmart™ team analyzed the key stories, leveraging the Machine Learning, Big Data Bayesian Network Analysis, Neural Network Analysis, Text Analytics, and Sentiment and Valence Analysis capabilities of AroniSmartInvest™ and AroniSmartIntelligence™ and uncovered actionable insights.

General Market Events and Sentiments

The Market Sentiment remains neutral or in negative territories across several sectors and sites. The focus of the news has shifted from earnings for big companies and small companies to inflation, public debt, infrastructure, and new technologies, including chip making. Inflation, uncertian news on EV (electric vehicles), cryptocurrencies, chip shortages, and crowd investments continue to weight heavily, even when a trend on the expections is becoming clearer.

The analysis highlights multiple dynamics, for the stock profile, the segmentation of stocks, the market profile and the sentiment in general.

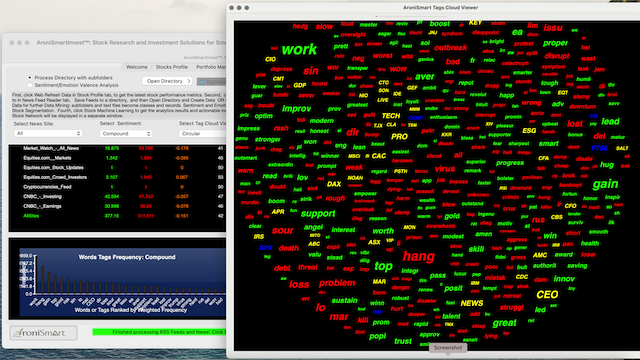

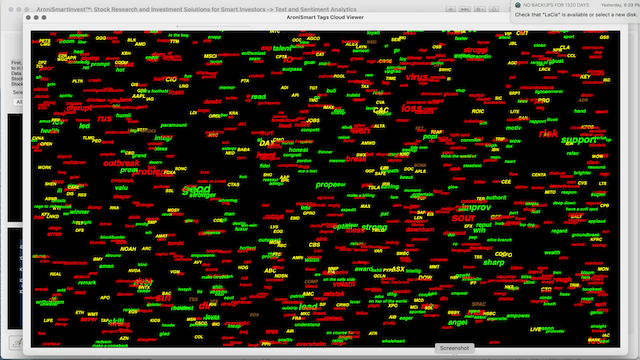

AroniSmartIntelligence™ Analysis of Positive and Negative Sentiment words.

The sample screen shot below shows some of the key stocks tickers, with high overall index in the AroniSmartInvest Tags word cloud and Bayesian Network analysis. A more complete view may be produced using the Bayesian Network and Sentiment Analysis capabilities in the Machine Learning module or AroniSmartInvest or both the Neural Network and Bayesian Network capabilities of AroniSmartIntelligence®

From the figure above, it appears the Tech, Energy, Economy and Inflation related tags are prominent, highlighting the dominance of news about earnings, inflation, Tech companies challenges and employment. The dominance of Retail, Energy, Tech, Oil and Healthcare stocks and news related word tags remain dominant as expected.

As depicted in the complete Words Cloud and Tags view, for which a partial screen shot is given above, it was found that, as in previous analyses, the positivity (see words in green) continues to be driven by words such as comeback, health, on course, support, improv, innov, interest, etc. The words cloud points to the continued improving companies earnings, healthcare, retail, oil energy , COVID-19 vaccinations, new innovations, Solar Energy, and the continued government support to improve economic performance.

The negativity continues to come from the market volatility, downturn, risk, rough, debt, and job market, and overal challenges related to uncertainties and risks while trying to overcome the last crisis, while avoiding potential pitfalls.

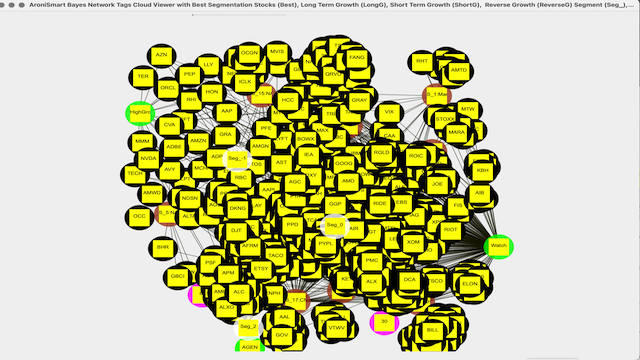

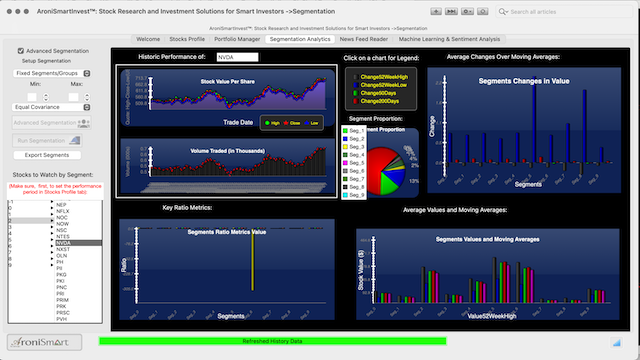

AroniSmartInvest™ in Action: Segmentation and Key Stocks Driving the Market Sentiment

The stock analysis continues to reinforce the earlier findings on the sectors driving the markets. The stocks include TECH, Retail, Banking, Healthcare, Energy and Transportation. Tech sector appears to have mixed results, whereas Healthcare, Retail, Transportation, Energy, and Banking maintain their upward momentum. In the current analysis, the optimal segmentation analysis continued to keep the 10 segments, with an additional bucket of outliers (-1), with different performance, in terms of technicals and fundamentals, with most TECH companies shifting to segments with decling momentum (see below).

The stocks with strong trends, as identifed in AroniSmartIntelligence and AroniSmart words cloud and Bayesian Network include the following, with a few micro chips makers (green):

- TER - Teradyne, Inc., which specialises in automatic test equipment worldwide, including Semiconductor Test, System Test, Industrial Automation, and Wireless Test.

- AZN - AstraZeneca PLC: a Healthcare Company, one of the COVID-19 Vaccine supplier worldwide, 3.21% week

- MMM: 3M Company (MMM), Safety and Industrial, Transportation and Electronics, Health Care, and Consumer

- NVDA - Nividia operates in two segments, Graphics and Compute & Networking, with products and chips used in gaming, professional visualization, datacenter, and automotive markets.

- TECH - Bio-Techne Corporation): develops, manufactures, and sells life science reagents, instruments, and services for the research and clinical diagnostic

- ADBE - Adobe Inc.: diversified software company worldwide, with the Digital Media tools and solutions and a Creative Cloud

- AMZN - Amazon - E-retail, Cloud Solutions, Media

- CVA - Covanta Holding Corporation: conversion of waste to energy, waste transport and disposal, and renewable energy generation.

- ORCL: Oracle

- LLY - Eli Lilly and Company : Healthcare company

- PEP - PepsiCo, Inc.: food and beverage company worldwide

- HON - Honeywell International Inc.: diversified technology and manufacturing company worldwide

- MSFT - MicroSoft

- AVY - Avery Dennison Corporation, manufactures and markets pressure-sensitive materials

- ADP - Automatic Data Processing, Inc. (ADP); cloud-based human capital management solutions

- RHI - Robert Half International Inc.: staffing and risk consulting services

- MCHP: Microchip Technology Incorporated: develops, manufactures, and sells semiconductor products forembedded control applications.

The list of stocks highly impacted on May 30, 2021 has varied since the last analysis. TECH, Retail, Banking, chip, Energy, Car makers, and Retail companies have a high weight. Apple (AAPL), MicroSoft (MSFT), Johnson & Johnson (J&J), Tesla(TSLA), Amazon (AMZN), Moderna(MDNA), Pfizer(PFE), General Motors (GM), Exxon Mobil Corporation (XOM), Oracle(ORCL), Bank of America (BAC), JP Morgan Chase & Co (JPM), Walmart (WMT), AT&T (T), Cisco Systems(CSCO), Advanced Micro Devices, Inc. (AMD), NVIDIA(NVDA), etc... continue to drive the market and appear in the analysis. The Bitcoin and EV stocks also continue to play a major role. The figure below shows a sample of stocks in news in the High Growth and Short Term Growth groups, accross all the 10 identified segments, mostly mentionned in the news on May 19, 2021.

More detailed analyses, including stock segmentation and profile analysis can be conducted using Big Data, Machine Learning, Neural Network, Time Series and Sentiment Analysis capabilities of AroniSmartInvest and AroniSmartIntelligence™.

Advertisement

GET ARONISMARTINTELLIGENCE on App Store

AroniSmartIntelligence, the leading tool for Advanced Analytics, Machine Learning, Neural Network, & Data Science

Statisticians, Data Scientists, Business and Financial Analysts, Savvy Investors, Engineers, Researchers, Students, Teachers, Economists, Political Analysts, and most of the practitioners use Advanced Analytics to answer questions, to support informed decision making or to learn.

AroniSmartIntelligence™ is a leading Advanced Analytics, Machine Learning and Data Science tool, with optimized cutting edge Statistics models, Econometrics, Big Data and Text Analytics.

AronismartIntelligence™ includes modules covering Machine Learning and Big Data mining, Unstructured Text Analysis, Sentiment and Emotion Analytics, Bayesian Statistics and other advanced analytics.

@2021 AroniSoft LLC

For More on AroniSoft LLC andAroniSmart products click here