Stocks across all sectors, especially in Tech, Healthcare, Financial Services, Energy, and Consumer have been delivering differential returns over the last years including in 2021, 2022, and Q1- early Q4 2024. Most stocks reached heights in December 2021. Then, in 2022 and up to mid-Q1 2023, the stock growth became broadly negative across most sectors, except energy. The major stock market indices were also impacted. Since then, many stocks across all sectors, along with the key market indices have been on the rise, on a path to reaching the 2021 levels. In a sample of key stocks to watch, as identified by AroniSmart™ team, leveraging the Machine Learning, Econometrics, and NLP capabilities AroniSmartIntelligence™ and AroniSmartInvest™, most stocks have shown resilience and sometimes outperforming most of the other stocks and the key stock market indices. As the end of Q4 2023 is reached , almost all the stocks, along with the key indices have reached highs, even aiming at their record highs.

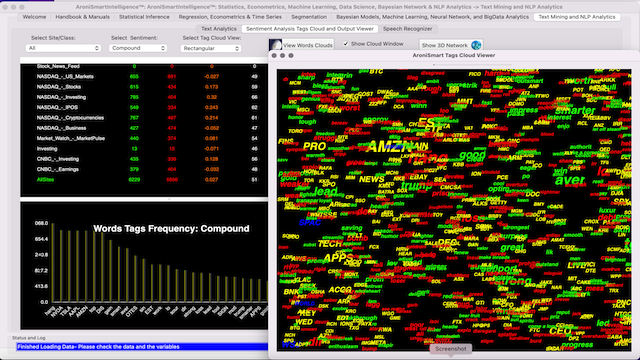

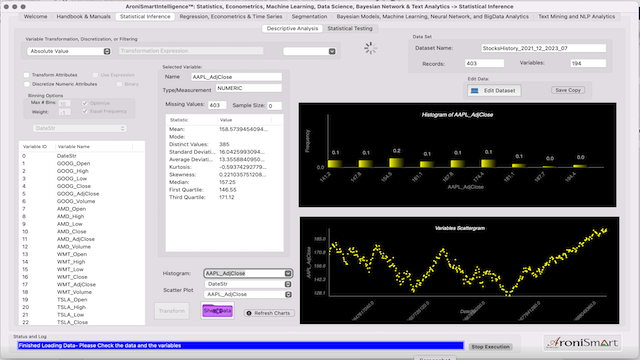

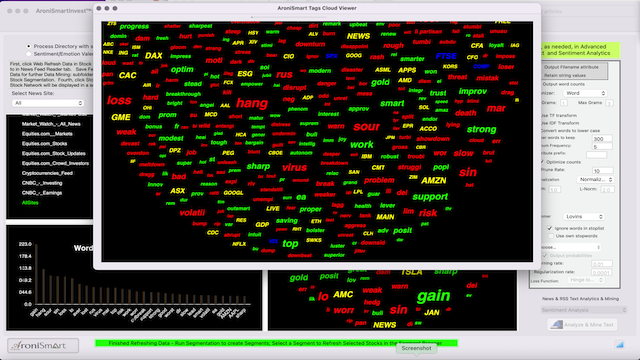

AroniSmart™ team, leveraging the Machine Learning Time Series capabilities, including Support Vector Machine, and Dominance Analysis of AroniSmartIntelligence™ and AroniSmartInvest™, has looked at the trends of the stock prices of 21 selected companies between Q4 2021 and Q4 2023 and came up with insights and projections on the dynamics. This is the Part 2 of the analysis. The findings captured in Part 1 may be seen here: AroniSmartIntelligence™ in Action: Stock Performance Analysis with Sentiment Analysis, Support Vector Machine and Dominance Analysis in Q4 2023 - Part 1.

Part 2 insights are presented below (for disclaimer and terms, check AroniSoft website).