In June 2017, AroniSmartInvest™ In Action, based on the analysis with AroniSmartInvest, predicted that Wal*Mart (NASDAQ: WMT) had started to build a momentum expected to accelerate for the rest of 2017 and 2018. AroniSmartInvest in Action projections were based on the several factors, that we will revisit shortly. In July 2018.

At the time, Wal*Mart stock (NASDAQ: WMT) had been soaring. June 2017 Year-to-date (YTD), the stock was up 15%, from $69.12 on Dec 30, 2016 to $79.36 on June 9, 2017 and 22% up since February 2017. What happened since then?

What happend to the Wal*Mart stock momentum?

Immediately after AroniSmartInvest team's predictions, the stock started a strong rally. By October 2017 it rose to $88.48, or 17%. In November and December 2017, the stock reached $99.62 or 31% and by January 2018, it had peaked to $109.55 or 44%. It then, like the entire stock market, started a downward movement. When AroniSmart In Action confirmed the trend in July 20, 2019, the stock price was $88.00, or around 16% growth, since June 2017. By the end of Summer 2019, Walmart stock is trading at $114.69, or 65% increase since the initial sentiment analysis by AroniSmartInvest In Action.

Analyzing Wal-Mart Stock Performance

With the performance, it is time to revisit the question asked then on why Wal-Mart momentum was coming. AroniSmartInvest will then revisit the prospects for the stock in the short term and next year. AroniSmartInvest in Action gives hints based on AroniSmart stock segmentation and sentiment analytics.

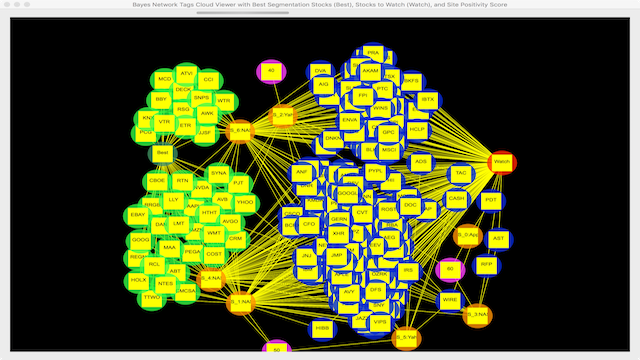

AroniSmartInvest In Action™ team has tried to look at the options, using AroniSmartInvest™ proprietary advanced analytics and machine learning algorithms combining stock segmentation and text and sentiment analytics (check the featured image to see Wal-Mart node in the AroniSmart network analytics). Stock segmentation in AroniSmartInvest™ combines both fundamentals and overall performance. Based on the results of segmentation, Wal-Mart stock has been, since last year, flagged among the stocks to watch.

The Segment in which Wal-Mart (WMT) stock has been classified includes the stocks with high EPS (earnings per share) and P/E (price-per earnings) ratios and a stable long term debt balance. Wal-Mart has currently P/E of around 25.95 and EPS of 4.44 similar to 4.5 in mid 2017. The prediction for 2020 is above $4.5. As predicted, it has distributed a quarterly dividend of $.51 in 2017 and $.52 in 2018 and $.53 in 2019

What Wal-Mart has been up to?

Faced with stiff competition mostly from e-commerce, especially Amazon, Wal-Mart has been fighting back, and the market is responding well.

Wal-Mart' acquired Jet.Com after paying $3.3 billions to shore up its online strategy and presence(see our article: Wal-Mart Walking in Amazon Footsteps by acquiring Jet.com?).

Advertising:

GET ARONISMARTLYTICS on App Store