Wal-Mart stock (NASDAQ: WMT) has been soaring. Year-to-date (YTD), the stock is up 15%, from $69.12 on Dec 30, 2016 to $79.36 on June 9, 2017 and 22% up since February2017. The question may be now: where is Wal-Mart stock headed? What are the prospects for the stock in the short term and next year. AroniSmartInvest in Action gives hints based on AroniSmart stock segmentation and sentiment analytics.

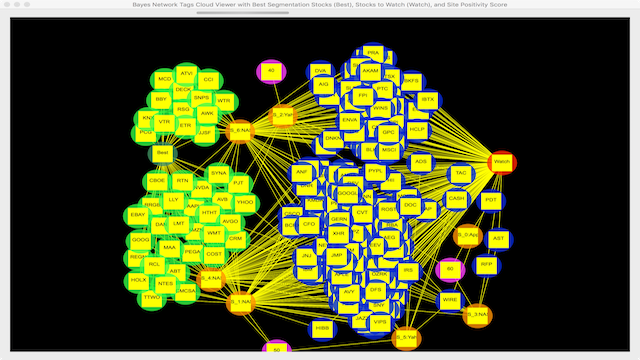

AroniSmartInvest In Action™ team has tried to look at the options, using AroniSmartInvest™ proprietary advanced analytics and machine learning algorithms combining stock segmentation and text and sentiment analytics (check the featured image to see Wal-Mart node in the AroniSmart network analytics).

Stock segmentation in AroniSmartInvest™ combines both fundamentals and overall performance. Based on the results of segmentation, Wal-Mart stock has been, over recent weeks, flagged among the stocks to watch.

The Segment in which Wal-Mart (WMT) stock has been classified includes the stocks with high EPS (earnings per share) and P/E (price-per earnings) ratios and a stable long term debt balance. Wal-Mart has currently P/E of around 18.02 and EPS between 4.38 and 4.57 in the last quarters. It has distributed a dividend of $.51, with a projected increase. Operating income in 3-months ending 2017-04-30 is up vs year ago, along with Revenues.

Wal-Mart stock is at the levels of 3 years ago, when it started to face stiff competition from e-commerce, especially from Amazon. Year-to-Date, Wal-Mart's stock price growth is beating S&P 500 and Dow Jones and is at par with NASDAQ.

Based on the analysis with AroniSmartInvest, it appears that Wal-Mart has started a momentum, expected to accelerate for the rest of 2017 and 2018.

In fact, Wal-Mart's recent acquisition of Jet.Com after paying $3.3 billions is expected to shore up its online strategy and presence (see our article: Wal-Mart Walking in Amazon Footsteps by acquiring Jet.com?). If the strategy succeeds and Wal-Mart fends off competition from Amazon and other on-line retailers, the rewards are expected to grow.

To show its commitment to the online strategy, Wal-Mart has been testing a new delivery program. With the program, store workers fulfill and deliver some orders placed on Walmart.com or Jet.com. If the program succeeds and is fully implemented at all the 4,700 Wal-Mart US stores, Wal-Mart will be able to leverage its brick-and-mortar presence to shore up its on-line business. This presents an advantage over Amazon.com which only relies on on-line fulfillment.