After a fueled momentum over 2021, the stock market has started the year 2022 with volatility. The latest Q3 2021 stock market perfomance figures reminded of the increasing market volatility and other dynamics in late Q1 and early Q2, 2021. Major questions coming from AroniSmartIntelligence™ users have over the 2021 year focused on how to use AroniSmartIntelligence capabilities to analyze the connection among the key Stock market indices, especially NASDAQ vs Dow Jones(DJI), S&P 500, Russell 2000, Gold, and Oil. AroniSmart™ team, leveraging the Machine Learning Time Series capabilities, including Support Vector Machine, and Neural Network Analysis of AroniSmartIntelligence™ , has analyzed the trends of NASDAQ and DJI vs the other stock indices (DJI, S&P 500, Russell 2000, Oil, Gold) between early Jan 2021 and early Jan 2022 and came up with insights and projections on the dynamics. The insights are presented below (for disclaimer and terms, check AroniSoft website. For related analyses of Stock Markets using Time Series, Dominance Analysis, and Neural Network capabilities see here AroniSmartIntelligence™ in Action: Time Series Support Vector Machine and Neural Network Analysis of Stock Market Indices in Q4 2020 - Q4 2021)

The analysis produced the different measures of forecasting accuracy, including directional accuracy of Stock market indices. Directional accuracy is an important statistic when ones tries to look at the prediction of a given stock market indice vs others, for example, as in this case, the NASDAQ , S&P500, or DJI Adjusted Closing Price as a function of Open, Low, High, and Closing Prices and volume of other market indices, Gold and Oil.

A little bit of the usual investment research before coming back to AroniSmart™'s findings.

Indices Momentum

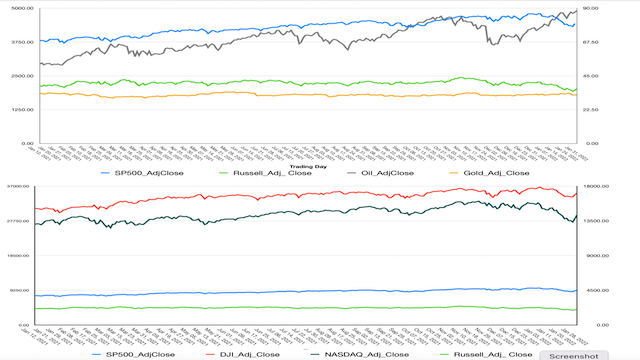

In general all indices have experienced an upward momentum over 2021 and to January 7, 2022: Dow Jones (.DJI) has grown by 16.84% to 36,231.66; S&P 500 (.INX) by 23.09% to 4,677.03; Nasdaq Composite (.IXIC) by 14.57% to 14,935.90; Russell 2000 Index (RUT) by 4.25% to 2,179.84, Crude Oil by 50.7% to 78.95 and Gold by -1.93% to 1,794.00. Only Gold has seen a negative performance. However the dynamics in the last 6 months (July 2021- early Jan 2022) have been characterized by high volatility, with some gains lost for most indices: Dow Jones (.DJI) has increased by 3.75%; S&P 500 (.INX) increased by 6.63%; Nasdaq Composite (.IXIC) increased by 5.5%; Russell 2000 Index (RUT) decreased by 5.6%, Crude Oil increased by 5.6% and Gold decreased by 1%

Since the beginning of 2022, all indices have been decreasing: Dow Jones (.DJI) has decreased by 0.97%; S&P 500 (.INX) decreased by 2.49%; Nasdaq Composite (.IXIC) decreased by 5.66%; Russell 2000 Index (RUT) decreased by 4.08%, Crude Oil increased by 4.1% and Gold decreased by 1.92%.

Hence, although the dynamics of all the stock indices appear aligned, there appears to be some significant differences in the details. All the indices behaved similarly, when looking at the factors that have been affecting the overal market since early 2021, such as COVID-19 pandemic, the last US general elections, the uncertainty on the job market, the growing inflation, and the economic policies over 2021 and the dynamics in late 2021 and Jan 2022, including the COVID-19 Omicron variant and the expected economic policies . Then, each indice factored the dynamics unique to the sectors dominating its specific composition.

Advertisement

GET ARONISMARTINVEST, A LEADING INVESTMENT RESEARCH TOOL, BASED ON Advanced Analytics, machine Learning and Data Science on App Store -- click here

Similar Trends with Differential Nuances.

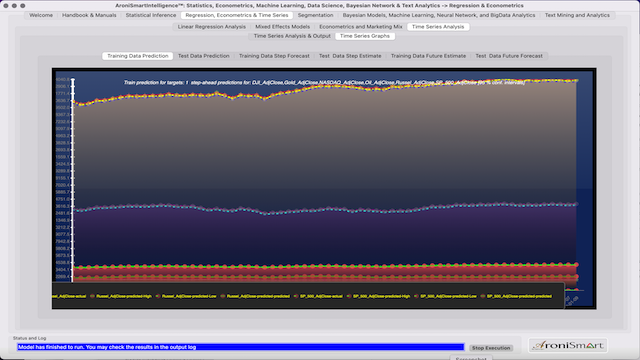

AroniSmart™ team analyzed stock indices performance dynamics, leveraging the Econometrics and Time Series Support Vector Machine and Neural Network Multilayer Perceptron capabilities of AroniSmartIntelligence™ and uncovered interesting insights, as shown below. The team analyzed the performance of NASDAQ, DJI, S&P500 Adjusted Close vs Open and High prices of the other indices (DJI, S&P 500, Russell 2000, Crude Oil, and Gold) , and each indice's Adjusted Close vs other indices prices (open, low, high, adjusted close) and volume, from January 11, 2021 to January 7 2022.

From the analysis, it was found that these indices basically follow similar trends. Also, they are all similarly impacted by the market conditions. However, the analysis found important nuances.

The key findings highlight: the indices studied had an upward momentum over the period. However, like the general stock market, they faced a slowdown and high volatility in late Q1-Q2 2021 before starting a bounce back, then going on a seesaw movement. Trendwise, since June 2021, the stocks have been on fueled momentum reaching high or record price levels. The upward momentum accelerated in Januay, June, July and August 2021. Then in September and October, 2021, the dynamics pointed to a slow down, downward trends, seesaw movements, and probably a potential correction. The volatility increased in Q4 2021. In January 2022, all indices have been giving up some gains.

Figure 1: Key Indice Price Trends in Jan 2021-Sep 2022 -- Training Data model.

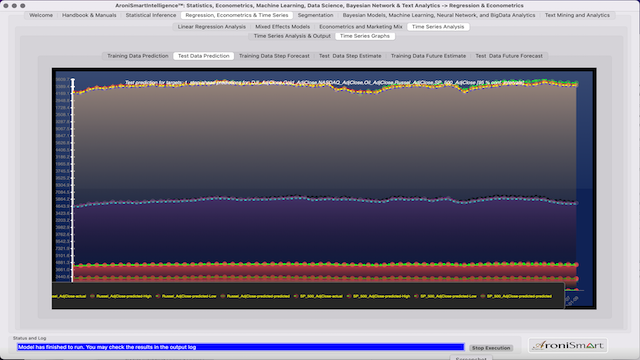

Figure 2: Key Stocks Indices Trends in Oct 2022- Jan 2022 -- Test Data model.

Over 2021 all the stocks indices built on an earlier momentum, almost following similar trends.

By July of 2021 most indices were above the average Q1 2021 levels. In early Q2 2021, the momentums of all indices were significantly impacted by the market conditions. In late May 2021, they bounced back and maintained momentum until late September 2021 (see charts below). Since then, the indices have been experiencing seesaw dynamics. The new market conditions, including the news about the pandemic have severly impacted all indices since December 2021 into January 2022. As expected, the indices do not exactly follow the same trends and projections, neither in training nor in test data (see DJI and NASDAQ examples below).

Figure 3: Dow Jones (DJI) Step Estimate Oct 2021 - Jan 2022

Figure 4: NASDAQ, DJI, S&P500, Russell 2000, Gold, Crude Oil Index Trends and AroniSmart Projections Analysis Between Jan 2021 and Sep 2021

Figure 5: NASDAQ Stock Market Index Trends and AroniSmart Projections Analysis Between July 2021 and January 2022

AroniSmartIntelligence™ modelling shows the stock indices that appear to mirror each other: a high opening for the stock market indices that tends to lead a decline or slow down in NASDAQ's adjusted closing price and a high opening for the stock market indices that tends to lead an increase or growth in NASDAQ's adjusted closing price. Late Q4 2020 - Early Q1 2020 and late Q2- early Q3 dynamics appear to positively impact NASDAQ Index, whereas the end of Q3-early Q4 2021 appears to have been challenging.

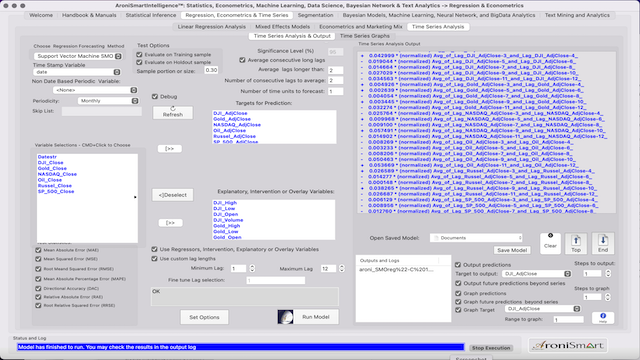

AroniSmartIntelligence™ analysis, using Time Series Support Vector Machine modelling and Neural Network Multilayer Perceptron, shows below the weights of the different indices and the forecast statistics. From the statistics, directionary accuracy is in general high, pointing to overall similar dynamics across all maket indices.

Figure 6 - a: DJI, NASDAQ, SP500, Russell 2000, Gold and Crude Oil Stock Index Dynamics and Statistics - AroniSmart Support Vector Machine Analysis Results for the Period Between January 2021 and January 2022: Statistics

Figure 6 - b: Stock Index Dynamics and Statistics - AroniSmart Support Vector Machine Analysis Results for the Period Between October 2020 and October 2021: Weights - DJI example.

AroniSmartLytics™ Neural Network Analysis confirms Time Series Support Vector Machine results: NASDAQ and DJI momentum negatively impacted in late Q1 2021 - early Q2 2021, late Q3 2021 and late Q4 2021 into January 2022, generally aligned with the momentum of most of other stock market indices.

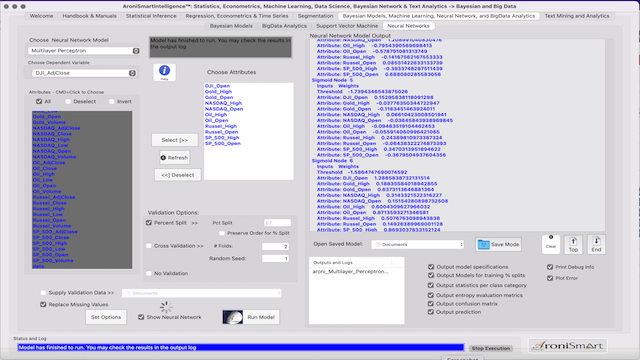

AroniSmart™ team analyzed NASDAQ's performance dynamics using Neural Network Analysis capabilities of AroniSmartIntelligence™ and uncovered insights confirming the performance dynamics of NASDAQ vs other market indices from January 2021 to January 2022. See below:

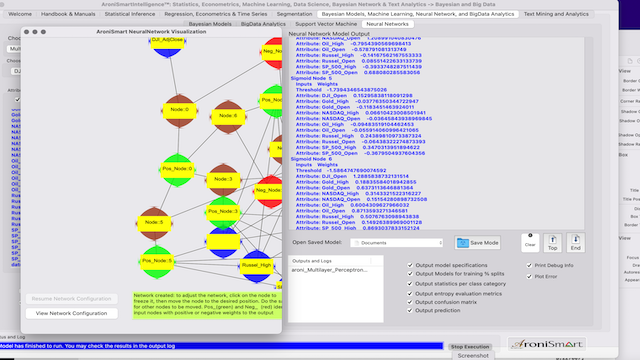

Figure 6-a: DJI Stock Index Dynamics - AroniSmart Neural Network Analysis Results for the Period Between January 2021 and January 2022

Figure 6-b: DJI Stock Index Dynamics - AroniSmart Neural Network Analysis Results - Model Setup and Network for the Period Between January 2021 and January 2022

Figure 6-c: DJI Stock Index Dynamics - AroniSmart Neural Network Analysis Results - Weights for the Period Between October 2020 and October 2021

More detailed analyses can be conducted using AroniSmartIntelligence™ Big Data, Machine Learning, Time Series, Neural Network and Sentiment Analysis capabilities and AroniSmartInvest™.

For more on AroniSmartIntelligence and AroniSmartInvest capabilities, visit AroniSoft web site by clicking here. AroniSmartInvest™ and AroniSmartIntelligence ™ are available on Apple's App Store.

©2022 AroniSoft LLC

Advertisement

GET ARONISMARTINTELLIGENCE™ on App Store

AroniSmartIntelligence™, the leading tool for Advanced Analytics, Machine Learning & Data Science

Statisticians, Data Scientists, Business and Financial Analysts, Savvy Investors, Engineers, Researchers, Students, Teachers, Economists, Political Analysts, and most of the practitioners use Advanced Analytics to answer questions, to support informed decision making or to learn.

AroniSmartIntelligence™ is a leading Advanced Analytics, Machine Learning and Data Science tool, with optimized cutting edge Statistics models, Econometrics, Big Data and Text Analytics.

AronismartIntelligence™ includes modules covering Machine Learning and Big Data mining, Unstructured Text Analysis, Sentiment and Emotion Analytics, Bayesian Statistics and other advanced analytics.