U.S. stocks rallied on Friday Oct 28, 2022. The rally ended a period of major declines. In general, the month of October 2022 is ending with mixed, but improving, trends, following the disappointing Q3 2022, in which stocks experienced erratic downtrend seesaw movements, full of volatility complicated by a mix of high expectations and deep disappointments. On October 29, 2022 AroniSmart™ team, leveraging the NLP, Text and Sentiment Analysis, Machine Learning, Data Science, Time Series and Support Vector Machine capabilities and Dominance Analysis of AroniSmartInvest ™ and AroniSmartIntelligence™ tools, looked at the stock market news and trends. From the latest analysis, the team came up with insights and highlights on key stocks and the market sentiment driving the dynamics of the stock market as the Q4 2022 progresses.

The dynamics during Q3 2022 were mostly driven by the rising inflation, Federal Reserve Bank's interest policies, and international events, including the war in Ukraine and its impact on the world economy. In early Q4 2022, as found in the analysis by AroniSmart™ team, the trends were shifting to positivity, fueled by company earnings, stabilizing inflation, and easing worries of recession, though heavy uncertainties remained.

Key Insights based on AroniSmart Analysis

Since mid-Q2 2022, the stock market has been experiencing swing slide seesaw dynamics. After the high volatility mixed with some positive trends in July 2022, positive trends were observed in August 2022. In the first 3 quarters of 2022, the three major indices registered heavy and increasing losses. The consecutive losses for S&P 500 and Nasdaq Composite were a first since the 2008 Global Financial Crisis, whereas for the Dow Jones, since 2015.

On August 13, 2022, AroniSmart™ team, leveraging the NLP, Text and Sentiment Analysis, Machine Learning, Data Science, Time Series and Support Vector Machine capabilities and Dominance Analysis of AroniSmartInvest ™ and AroniSmartIntelligence™ tools, looked at the stock market data, news and trends. The analysis showed that by mid-Q3 2022 the dynamics had changed, with positive trends and improvements of all key market indices, except Crude Oil. On September 21, 2022 AroniSmart™ team updated the analysis and came up with insights and highlights on key stocks and the market sentiment driving the dynamics of the stock market towards the end of Q3 2022.

On Monday October 3, 2022, as the Q4 2022 started, the three stocks benchmark indices recorded soaring performances: S&P 500 index jumped 92.81 or 2.59%; Dow Jones Industrial Average jumped 765.38 points, or 2.66%; while the technology-heavy Nasdaq Composite increased 239.82 or 2.66%. All three indices experienced their best days in the last three months, if not more. By the end of October, most of the indices continued to grow, although the big tech companies dragged down the NASDAQ Composite, mostly due to disappointing earnings.

By October 28, 2022, the three stocks benchmark indices maintained or improved the performances during the month: S&P 500 index jumped 315.44 or 8.7%; Dow Jones Industrial Average jumped 4,136.29 points, or 14.39%; while the technology-heavy NASDAQ Composite increased by 286.83 or 2.71%.

The gains continue to build following a challenging 3rd quarter, but most importantly the worsening performance in September 2022.

In September, the S&P 500 lost 9.61% and 6.27% for the quarter, DJI 8.28% and 7.63% and the NASDAQ Composite 9.7% for the month and 4.96% for the quarter.

In the month of October 2022, most other indices, except Gold, also registered some gains:

CRussell Index, Crude Oil Dec 22 (CL=F), Gold Dec 22 (GC=F) and Silver Dec 22 (SI=F) performed respectively, as follows: +7.68%, +7.58%, -0.73%, +2.15%.

The oil prices appear to continue to be fueled by the reports about OPEC looking into significantly cutting oil production.

With the new performances, expectations for a better Q4 remain. Unlike Q3 2022, the companies's technicals and fundamentals, including earnings, along with the US mid-term elections may be the drivers of the performance in Q4 2022. The latest disappointing learnings of the Big Tech companies, including Alphabet, Microsoft, Meta have significantly impacted NASDAQ Composite Index.

The previous analyses had highlighted the probability of a market stabilization over Summer, despite persistent deep uncertainties and the fears of a recession. The trends observed in August and early September analyses appeared to validate the probabilities of temporary stabilization. Hover, the analysis towards the end of September pointed to many issues found based on the sentiment analysis using the Natural Language Processing (NLP) and machine learning and data science.

For example, negative sentiment words such as tip of iceberg, repress, bankrupt, mislead, meltdown, hang, catastroph, greed, disappoint, etc... weighted heavy and highlighted the challenges faced by investors and consumers, especially with persistent inflation and dire world events.

On the positive sentiment side, words like award, smart, improv, saving, leverage, bolster, progress, talent, work, sustain, support, gain, cheap, etc.. pointed to the Federal Reserve Bank and government policies targeting inflation.

In the latest analysis, the sentiment analysis has highlighted the following words tags in the cloud:

Positive tags: adequ, admir, allur, amaz, angel, applaud, calculated risk, correct, dazzl, enthusiasm, empowerm, euphor, guarant, immense, impress, inspir, legend, loyalt, master, matur, memor, paramount, pleas, pleasure, pardon, relief, remark, simplest, spark, stabil, smooth, strongest, uphold, understand

Negative tags: abrupt, antiq, authoritar, assail, bankrupt, cold, crash, danger, damag, deser, dilapid, disinterest, disregard, doom, embattl, embroil. drag, exhaust, grappl, hamper, interrupt, inadequat, invader, meager, oppress, oversight, plagu, pessim, slowest, stagn, stereotyp ,upheav, unsustain, volatil, virus, surrender

The positive tags appear to be shifting towards a more upbeat sentiment pointing the focus on company earnings, moving beyond inflation and persistence.

Negative tags still show that the recovery may be slow.

Advertisement

Get the following books on Amazon:

Legs of Tornado: The Human Who Outran the Wind, an African tale about a human from a humble upbringing who outran the wind, defeated evil spirits, overcame his fate, became a respected clan chief, and triumphed ever after.

Click Here to Get the books: Even Roosters Dream to Fly and Legs of Tornado

Even Roosters Dream to Fly along with Legs of Tornado are also available on Amazon worldwide and soon to several other platforms:

For more on the book, the author, the inspiration of the stories, Visit the author website here

Findings from AroniSmartIntelligence and AroniSmartInvest on October 28, 2022.

Below is a sample of the results from the analysis as of October 28, 2022. BIncluded are key stocks highlighted and expected to weight heavily on investment decisions and the associated sentiment analysis results.

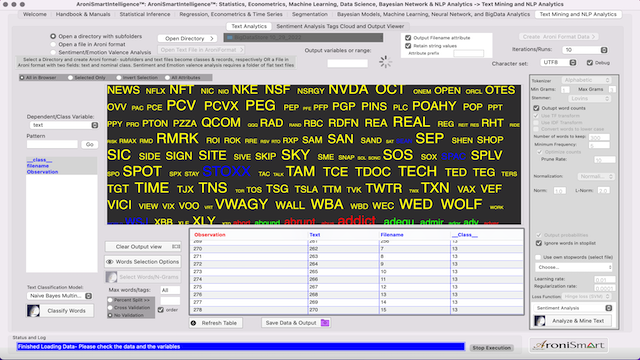

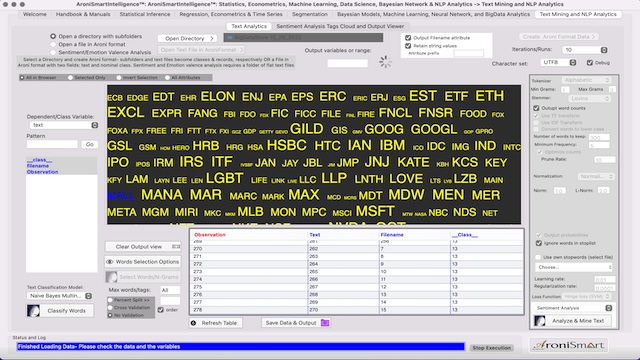

Figure 1: AroniSmartIntelligence Sentiment Analysis Stocks - October 28 2022 - Stocks Segmentation: Changes in prices and technicals.

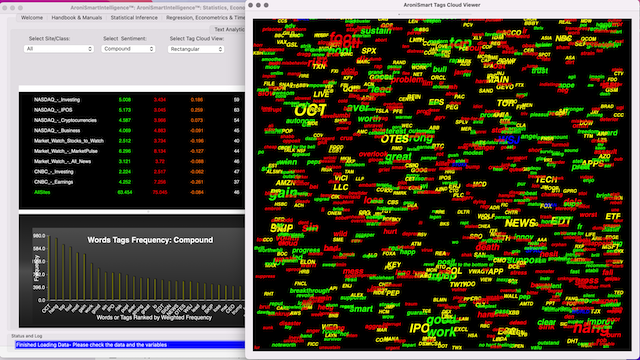

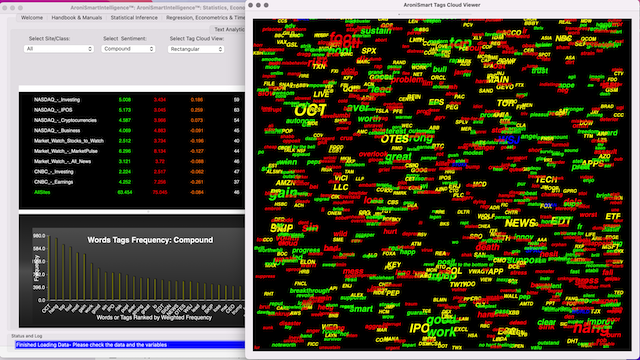

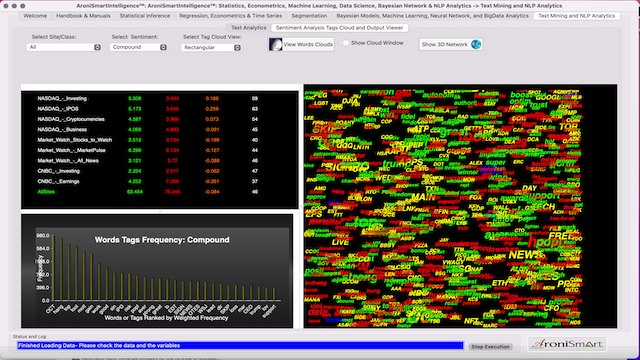

Figure 2: AroniSmartIntelligence Sentiment Analyisis Stocks and Word Tags and Positivity, October 28, 2022

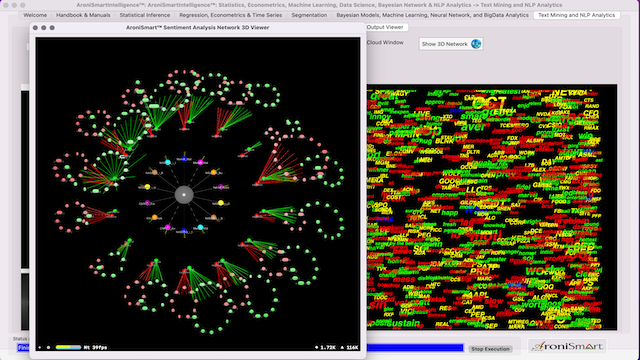

Figure 3: AroniSmartIntelligence Sentiment Analysis Tags and Sample Stocks to Watch October 28, 2022

Figure 4: AroniSmartIntelligence Sentiment Analysis and Stocks - October 28 2022 - Market Profile for AZN

Figure 5: AroniSmartIntelligence Sentiment Analysis Stocks - October 28 2022 - Stocks Segmentation: Changes in prices and technicals.

Figure 6: Market Profile: High Performing and Short Growth Stocks - Sample

Figure 7 : AroniSmartIntelligence Sentiment Analysis and Word Tags - October 28 2022

Figure 8: AroniSmartIntelligence Sentiment Analyisis Stocks and Word Tags and Positivity - October 28 2022

Figure 9: AroniSmartIntelligence Sentiment Analysis Stocks to Watch N - Z - October 28 2022

Figure 10: AroniSmartIntelligence Sentiment Analysis Stocks to Watch E - N - October 28 2022

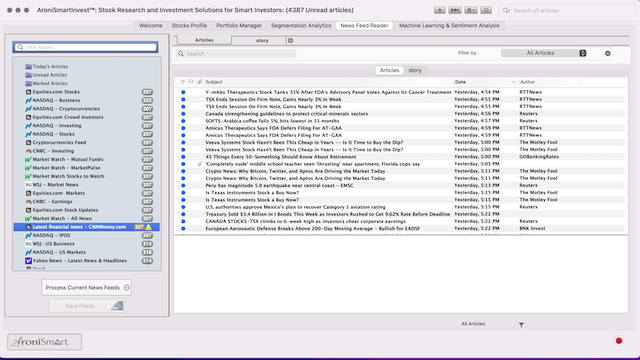

Figure 11: AroniSmartIntelligence Sentiment Analysis News - October 28 2022

Figure 12: AroniSmartIntelligence Sentiment Analysis - October 28 2022

More detailed analyses can be conducted using AroniSmartIntelligence™ and AroniSmartInvest™ Big Data, Machine Learning, Time Series and Sentiment Analysis capabilities.

For more on AroniSmartIntelligence™ and AroniSmartInvest™ capabilities, visit AroniSoft web site by clicking here. AroniSmartInvest™ and AroniSmartIntelligence ™ are available on Apple's App Store.

Advertisement

GET ARONISMARTINTELLIGENCE on App Store

AroniSmartIntelligence, the leading tool for Advanced Analytics, Machine Learning & Data Science

Statisticians, Data Scientists, Business and Financial Analysts, Savvy Investors, Engineers, Researchers, Students, Teachers, Economists, Political Analysts, and most of the practitioners use Advanced Analytics to answer questions, to support informed decision making or to learn.

AroniSmartIntelligence™ is a leading Advanced Analytics, Machine Learning and Data Science tool, with optimized cutting edge Statistics models, Econometrics, Big Data and Text Analytics.

AronismartIntelligence™ includes modules covering Machine Learning and Big Data mining, Unstructured Text Analysis, Sentiment and Emotion Analytics, Bayesian Statistics and other advanced analytics.

For More on AroniSoft LLC and AroniSmart products click here

For More on the latest version of AroniSmartIntelligence and AroniSMartInvest.

AroniSmartIntelligence™: Optimized Machine Learning, Advanced Analytics, and Data Science Capabilities Including Econometrics, Bayesian Models, Neural Network Models, Marketing Mix Models, and NLP Analytics

@2022 AroniSoft LLC