In February 2020, AroniSmart™ team, leveraging the Machine Learning, Text Mining, and Sentiment and Valance Analysis capabilities of AroniSmartLytics™ (AroniSmartIntelligence™), looked at the market sentiment index and events driving the stock market in early Q1 2020 (see here:ARONISMARTINTELLIGENCE™ IN ACTION: MARKET SENTIMENT AND KEY STOCKS IN FEB 2020 ). From the analysis, key major events and impacted stocks were highlighted. AroniSmart analysis showed that Year 2020 had started with a strong market performance. At the same time, major events were driving the market performance, including upcoming US Presidential elections and the Corona Virus pandemic in China. Since then, the pandemic due to Corona Virus, known as COVID-19, has spread across the entire World and the stock market has suffered, almost crashing, with the Dow Jones Industrial Average (^DJI) declining by 36% from 29,219 on Feb 20, 2020 to 18,592 on March 23, 2020. Since then, the stock market has been slowly coming back. AroniSmart team has now looked at the events driving the market sentiment and the overall stock market performance.

A little bit of the insights on the market events and sentiments, from AroniSmart™ team's findings, based on the data as of April 24, 2020.

General Market Events and Sentiments

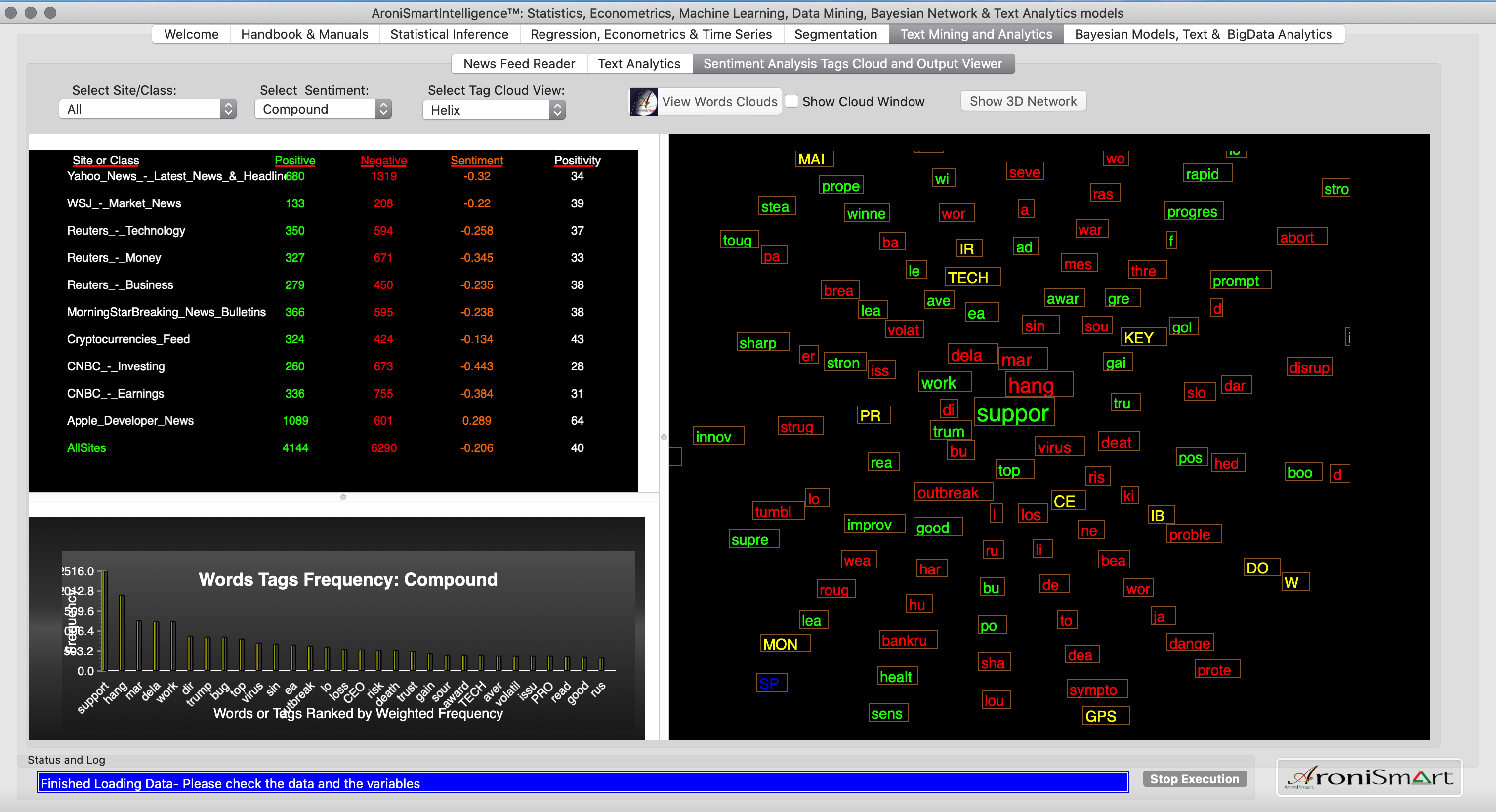

First, the overall sentiment is negative, across the board, which aligns with the market and economic situation and the overall market performance. This is a major developmeng since the February 2020 analysis, when the positivity index appeared not to match the performance of the market. It stands at around 40%, which indicates that negative events are significantly impacting the market more than the positive news and trends. The sentiment is negative across the board.

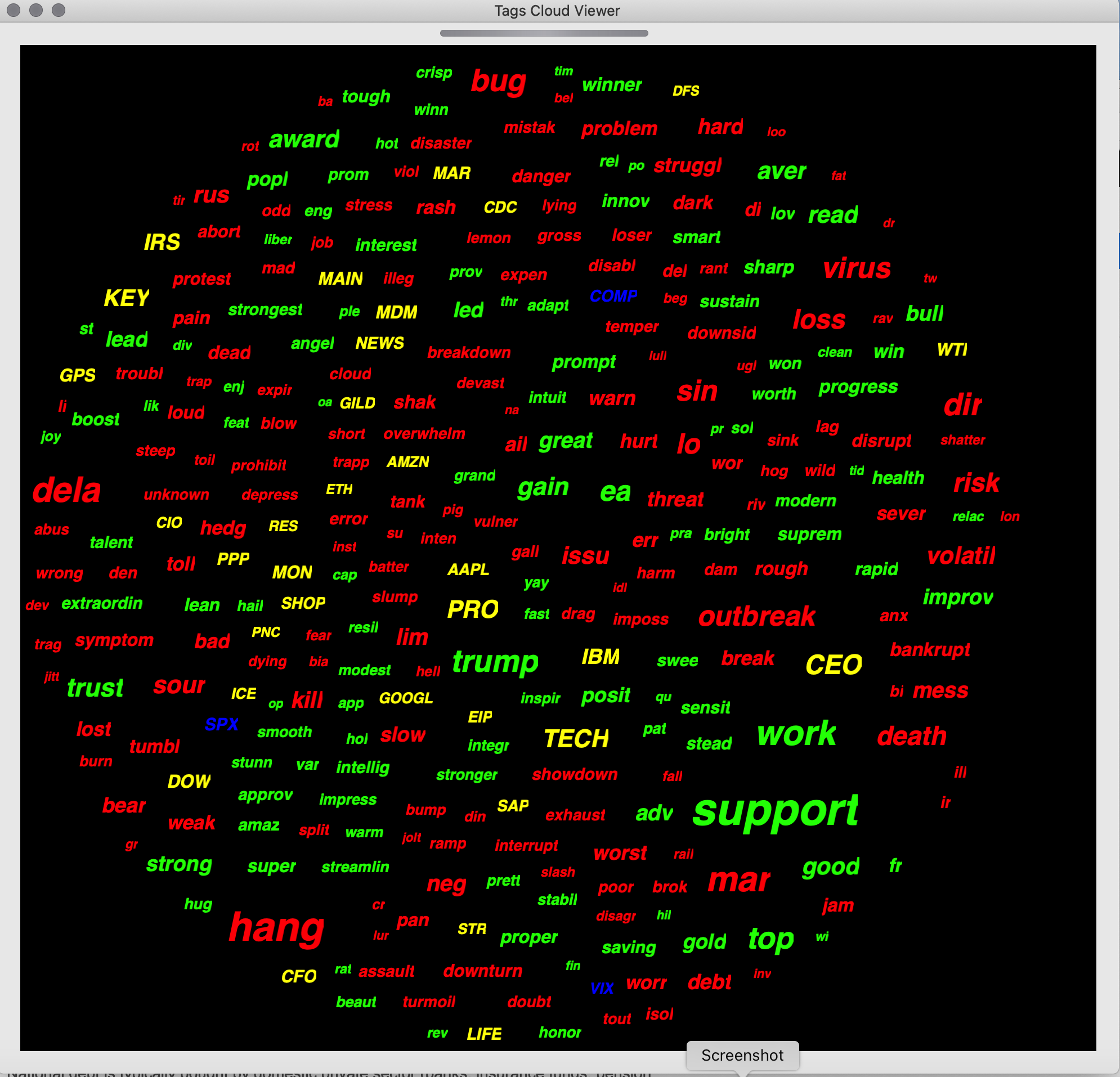

Second, the positive sentiments are connected with the economic relief, the support to small businesses and workers, the corona related relief, US elections and the latest market trends, folowing the stock market crash of March 2020.. Work, hang, risk, lead, virus, trump, hard, top, trust, good, gain words have the highest frequencies. Market connected keywods such as Gain, Improv, gold, led, innovation, steamline, interest drive the positive sentiment in the stories.

COVID-19 pandemic related terms, like virus, viol, unpopl, unsound, unwell, tortur, terror, thrown in the towel, undesir, outbreak, harm, symptoms, kill, threat, bug, hang, mess are driving the negativity and risk in the market.

AroniSmart™ team analyzed the key stories, leveraging the Tex Mining, Machine Learning and Sentiment and Valence Analysis capabilities of AroniSmartLytics™ (AroniSmartIntelligence™) and uncovered interesting insights.

AroniSmartLytics™ Analysis of Positive and Negative Sentiment words.

Based on the analysis, as depicted in the Words Cloud below, it was found that the the positivity (see words in green) is driven by words such as Support, Trust, Work, Progress, Award, Gain, Sustain, Improv. The words point to a mix of both the US politics (Trump, Support, boost, etc,) and the stock market performance.

The negativity appears to come from the virus outbbreak and death toll and the confinement consequences , but also from heightened disappointment, weakness, struggling, breakdown of the system , volatility, slump and the risk in the market.

AroniSmartInvest™ in Action: Key Stocks Driving the Market Sentiment

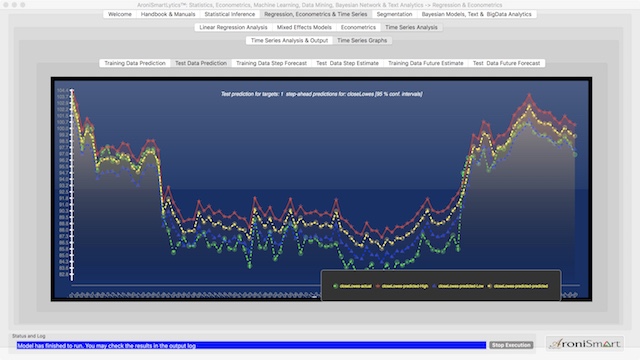

Based on the analysis, it was found that the TECH sector continues, in general, to drive the market, along with the few stocks basically following similar trends.

The sectors driving the markets appears to be TECH, Retail, Home Based Entertainment, and Healthcare with a strong momentum.

The key stocks, with high overall index, in the word cloud include: ABBV ACCO AIR AMAT AMZN APA AST AVG AXP BABA BBC BOX CBO CBOE CBS CCL CFR CIT CLM CMA CME COST CSCO CTSH CVS CVX CYTK DAX DFS DIS DOW DPZ ECL EFX EIP EOG ERJ ESG ETH ETP FDS FLIR FRT GILD GMO GOOG GPS GST HAL HCA HON HOPE HPE HSBC ICE INTC JNJ KBH KEY KKR KSS LEI LEO MAIN MAR MCD MDM MFA MIN MMM MSFT NDAQ NEWS NFLX NHS NOV NVDA PAC PDT PPP PRO RBC RES REV SALT SAN SAR SHAK SHOP SIG SIM SLB SMRT SON STR STS TECH TESS TGT TIME TRI WIRE WTI XOM ZEN.

For Healthcare, there are stocks such as CVS, GILD, JNJ, and In Home based entertainmen, NetFlix (NFLX).

More detailed analyses can be conducted using AroniSmartLytics™ Big Data, Machine Learning, Time Series and Sentiment Analysis capabilities.

Advertising:

GET ARONISMARTINTELLIGENCE (ARONISMARTLYTICS) on App Store

AroniSmartLytics™ (AroniSmartIntelligence™), the leading tool for Advanced Analytics

Statisticians, Data Scientists, Business and Financial Analysts, Savvy Investors, Engineers, Researchers, Students, Teachers, Economists, Political Analysts, and most of the practitioners use Advanced Analytics to answer questions, to support informed decision making or to learn.

AroniSmartLytics™ (AroniSmartIntelligence™) is a leading advanced analytics, machine learning and data science tool, with optimized cutting edge statistics models, Big Data and Text Analytics.

AroniSmartLytics™ (AroniSmartIntelligence™) includes modules covering machine learning and Big Data mining, Unstructured Text Analysis, Sentiment and Emotion Analytics, Bayesian Statistics and other advanced analytics.