Apple Inc. (NYSE: AAPL) has delivered strong returns in 2019 and 2020. Year-to-date, Apple stock price has risen by 28%. From July 2019, Apple stock price has risen by 87%. AroniSmart™ team, leveraging the Machine Learning Time Series capabilities and Dominance Analysis of AroniSmartIntelligence™, has looked at the trends of AAPL vs other 13 companies and came up with insights and projections on the dynamics.

A little bit of the usual investment research before coming back to AroniSmart™'s findings.

Advertisement

ARONISMARTINTELLIGENCE Leading Advanced Analytics, machine Learning and Data Science Tool on App Store

-- click here

Apple Momentum

Apple Inc. (NYSE: AAPL) has consistenly delivered strong returns since 2017. Since the last deep analysis of AAPL stock by AroniSmart team in November 2017 (see: AroniSmart: AroniSmartInvest In Action: Apple Stock Shoots Up Following Solid Financial Results and iPhone X Launch), Apple stock has increased by more than 240%. Over this year, AoniSmart Sentiment Analysis has shown that Apple's momentum has been fueled by new products and solutions (see: AroniSmart Tech News here and Apple's WWDC 2020: Apple Silicon, iOS 14, iPadOS 14, App Clips, macOS 11.0 and see: AroniSmartIntelligence™ in Action: Market Sentiment and Key Stocks in May 2020)

New Products at Apple

Since 2017, Apple has heavily invested in new technologies and products.

On March 25, 2019 Apple kicked off "It's show time" event at the Steve Jobs Theater on the company's Apple Park campus. During the events, 4 major offerings were unveiled: Apple tv+, Apple News+, Apple Arcade, Apple Card.

In the week of June 3, 2019 Apple unveiled major technologies and offerings, including a new Mac Pro, a new version of MacOS named Catalina, Catalyst, to improve portability of apps between Mac OS and iOS, iOS13 version, and iPadOS.

During “By Innovation Only” event held at Steve Jobs Theater on Sep 10, 2019 Apple introduced the iPhone 11, 11 Pro, and 11 Pro Max, as well as the Apple Watch Series 5. The three new iPhones included the high-end flagship iPhone 11 Pro and 11 Pro Max with Triple-Lens Rear Cameras. iPhone 11 comes with Dual-Lens Rear Camera, Dolby Atmos sound, a faster A13 Bionic chip, and six New Color

In the week of June 22, 2020 Apple kicked off its annual developers' conference, WWDC 2020, at the Steve Jobs Theater on the company's Apple Park campus. Unlike the prior years, this year's WWDC was without a live audience. During the event, major technologies and offerings were unveiled, including Apple Silicon, iOS 14, iPadOS 14, App Clips, watchOS 7, tvOS and macOS 11.0.

Hence over the last years, AAPL has consistently outperformed several technology companies and other stocks.

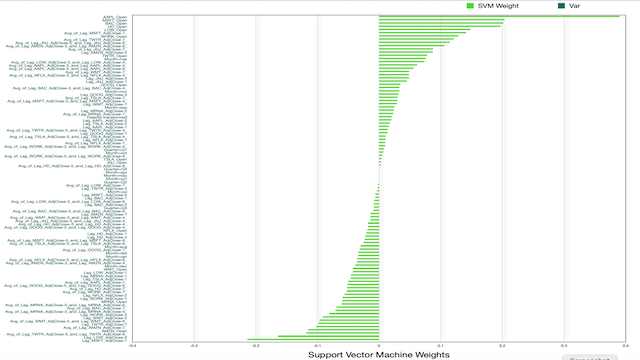

AroniSmart™ team analyzed Apple's performance dynamics, leveraging the Support Vector Machine and Dominance Analysis capabilities of AroniSmartIntelligence™ and uncovered interesting insights. The team analyzed the performance of AAPL vs 13 other internally selected stocks from July 2019 to July 2020.

AroniSmartLytics™ Analysis: Apple behaves like several stocks, but not the same

Based on the analysis, it was found that most of these stocks basically follow similar trends. Also, they are all impacted by the market conditions. However, the analysis found important nuances.

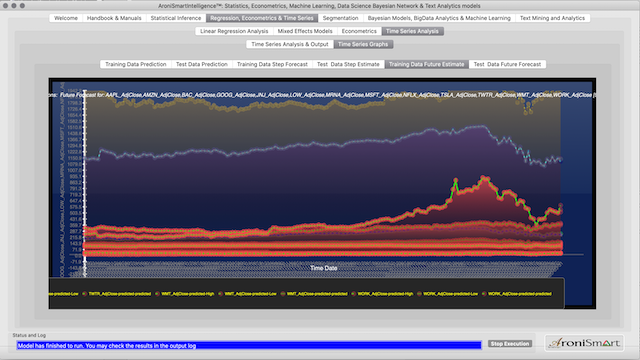

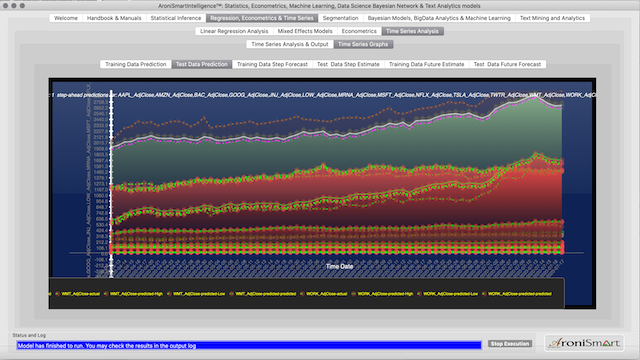

Key findings started with a positive view: most of the stocks had an upward momentum over the period. However, like the general stock market, they faced a slowdown and high volatility in Q1-Q2 2020 before starting a bounce back. Trendwise, since May 2020, the stocks have been on a catching up journey reaching the previous price levels.

Figure 1: Key Stocks Price Trends before the end of March 2020

Figure 2: Key Stocks Price Trends Since April 2020

By the july of 2020 most stocks had basically back to or above the previous levels. In Q1 2020, Apple's momentum was significantly impacted by the market conditions, but in late May 2020, it bounced back (see chart below). Since then, the Apple stock has mainitend the momentum.

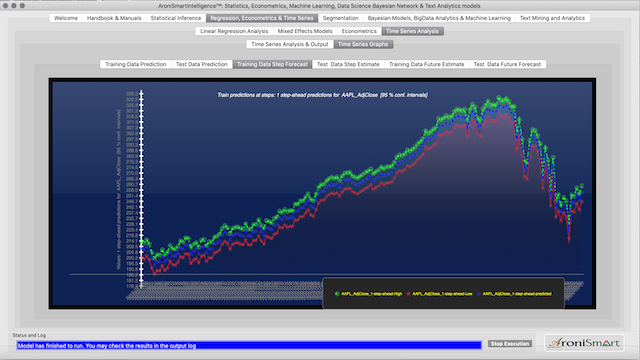

Figure 3: Apple Stock Price Trends and AroniSmart Projections Analysis Between July 2019 and March 2020

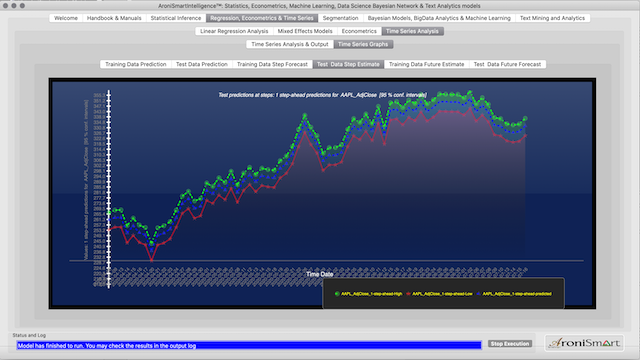

Figure 4: Apple Stock Price Trends and AroniSmart Projections Analysis Between April 2020 and July 2020

AroniSmartLytics™ modelling (see results on the Apple Close Price Drivers screen shot ), shows the prices of the stocks that appear to mirror each other: a high opening for the stocks that tends to lead a decline or slow down in Apple's closing price and a high opening for the stocks that tends to lead an increase or growth in Apple's closing price. Q2-Q4 2019 and Q2 - Jul 2020 dynamics appear to positively impact Apple's prices, whereas Q1 has been challenging.

Apple (AAPL) appears to build a momentum similar to that of MSFT, BAC, HD, LOW, WORK and to some extent TWTR and GOOG. At the same time, the upside of Apple appears not to align with the prices of NFLX, WMT, MRNA, and TSLA.

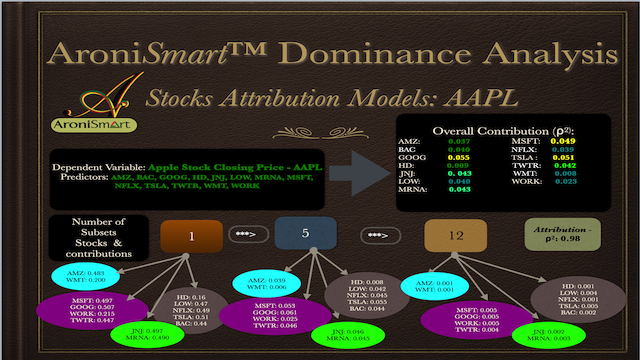

AroniSmartLytics™ Dominance Analysis confirms Support Vector Machine results: Apple momentum explained by momentum of other stocks.

AroniSmart™ team analyzed Apple's performance dynamics, Dominance Analysis capabilities of AroniSmartIntelligence™ and uncovered i insights confirming the performance dynamics of AAPL vs 13 other internally selected stocks from July 2019 to July 2020. See below:

More detailed analyses can be conducted using AroniSmartIntelligence™ Big Data, Machine Learning, Time Series and Sentiment Analysis capabilities.

Advertisement

GET ARONISMARTINTELLIGENCE on App Store

AroniSmartIntelligence, the leading tool for Advanced Analytics, Machine Learning & Data Science

Statisticians, Data Scientists, Business and Financial Analysts, Savvy Investors, Engineers, Researchers, Students, Teachers, Economists, Political Analysts, and most of the practitioners use Advanced Analytics to answer questions, to support informed decision making or to learn.

AroniSmartIntelligence™ is a leading Advanced Analytics, Machine Learning and Data Science tool, with optimized cutting edge Statistics models, Econometrics, Big Data and Text Analytics.

AronismartIntelligence™ includes modules covering Machine Learning and Big Data mining, Unstructured Text Analysis, Sentiment and Emotion Analytics, Bayesian Statistics and other advanced analytics.